Did you know? Recent data reveals that U.S. manufacturing employment plunged by 10% following the last major tariff implementation – a statistic too dramatic for any manufacturer to ignore. Trade tariffs and manufacturing have always shared a tense relationship, but the stakes are higher than ever. As governments around the world adjust tariff rates in pursuit of fairer trade, the manufacturing sector stands on uncertain ground—caught between policy shifts, supply chain disruptions, and global competition. In this article, we’ll cut through the political noise to deliver insights and opinions that may well decide the future of your business.

"Recent data reveals that U.S. manufacturing employment plunged by 10% following the last major tariff implementation – a statistic too dramatic for any manufacturer to ignore."

A Startling Shift: The Impact of Trade Tariffs on Manufacturing Employment

The intersection of trade tariffs and manufacturing represents one of the most volatile battlegrounds in global commerce. As policymakers deliberate over higher tariff rates to address trade deficit issues, manufacturers are forced to grapple with fluctuating input costs, dwindling manufacturing employment, and the ever-present threat of a trade war. When the United States imposed sweeping tariffs on major imported goods in recent history, the decision sent shockwaves across the manufacturing sector. Facts are clear: according to reliable data, manufacturing employment in the U.S. dropped by approximately 10% after a significant wave of tariff increases.

This plunge in manufacturing jobs reflected not just immediate job losses but a broader shakeup in how factories source materials, manage supply chains, and compete internationally. These changes are not just statistics; they hit the heart of communities that rely on stable, well-paying manufacturing employment. Tariffs aren’t confined to mere numbers—they are economic levers that can make, break, or transform a manufacturer’s future. Understanding the comprehensive impact of these policy tools is critical for leaders who want to safeguard their businesses and stay ahead of future trade policy shocks.

What You'll Learn About Trade Tariffs and Manufacturing

- How trade tariffs and manufacturing are interconnected

- The effects of trade deficit concerns on manufacturing jobs

- Key risks and opportunities for manufacturers in the current trade policy environment

- The role of the Trump administration in shaping policy

- Provocative opinions on whether your business is truly at risk

Trade Tariffs and Manufacturing: Unpacking the Relationship

Understanding the Basics of Trade Tariffs and Manufacturing

A trade tariff is a tax imposed by a government on imported goods as a means to regulate foreign competition and protect domestic industries. In manufacturing, tariffs typically increase the cost of importing raw materials or finished products, thereby forcing businesses to rethink sourcing and pricing strategies. When a nation like the United States introduces higher tariff rates or retaliatory tariffs, it intends to give its own manufacturers an edge. However, these well-intended policies can backfire.

Manufacturers often operate with global supply chains, importing vital components from around the world. When tariffs on imports rise, so do input costs, leading to squeezed profit margins or price hikes for consumers. For many small and mid-sized manufacturing businesses, even a small percentage point increase in input costs can mean the difference between growth and stagnation. The result? A ripple effect across the manufacturing sector—affecting not only jobs, but also investment, innovation, and long-term competitiveness on the global stage.

Why Are Trade Tariffs Used? (trade policy, trade deficit)

Governments often introduce trade tariffs as a measure against an unsustainable trade deficit—the difference between the value of a country's imports and its exports. Policymakers argue that higher tariffs on imported goods can help correct the trade imbalance by incentivizing domestic consumption and manufacturing. Such trade policy initiatives are commonly justified as serving the interests of national security, economic stability, or as leverage during complex trade deal negotiations.

Yet, while the intention might be to stimulate local manufacturing employment and bolster national competitiveness, the reality is often more complicated. Trading partners typically respond with reciprocal tariffs or other restrictions, leading to a trade war that can reduce exports from domestic manufacturers. For industries with deeply integrated supply chains, these tit-for-tat moves can disrupt operations, upend global collaborations, and deter long-term investments. Such outcomes raise the pivotal question: Do tariffs truly benefit the manufacturing sector, or do they impose more risks than rewards?

| Tariff Policy | Effect on Manufacturing Employment | Impact on Supply Chain |

|---|---|---|

| High Tariffs (20%+) | Significant job losses, plant closures, reduced investment | Increased input costs, disrupted global sourcing, longer lead times |

| Moderate Tariffs (5–15%) | Moderate impact, with some sectors seeing job shifts or gains | Supply chain rerouting, emphasis on domestic suppliers |

| Low/No Tariffs (0–5%) | Stable employment, competitive exports | Global supply chain integration, lower costs, flexible sourcing |

The Ripple Effect: How Trade Tariffs Impact Manufacturing Jobs

Manufacturing Employment: Data Trends and Shifts

The story of manufacturing jobs in the era of trade tariffs is primarily one of volatility. After high-profile tariff announcements—such as those targeting steel and aluminum during the Trump administration—manufacturing employment figures experienced noticeable swings. Some factories, banking on the promise of relief from foreign competition, initially ramped up hiring. Yet, by the end of the adjustment period, the sector saw nearly 10% fewer jobs nationwide, according to federal labor statistics.

Several factors contributed to these shifts. First, the direct effects of higher input costs made it difficult for manufacturers to sustain payrolls. Second, disrupted supply chains forced many to scale back production or move operations abroad. Finally, uncertainty over future trade policy chills investment, as factories delay expansions or upgrades due to unpredictability in sourcing and demand. For workers, these job losses are more than numbers; they represent a fundamental threat to economic stability, often hitting regions already struggling with the effects of prior trade deals and automation.

Manufacturing Job Losses: Causes and Global Comparisons

The causes behind manufacturing job losses in the post-tariff era are both domestic and global. Domestically, tariff increases and retaliatory measures have pressured manufacturing businesses to downsize, automate, or outsource production to international partners less affected by tariff rates. On a global scale, nations such as those in the Asia-Pacific region, not subject to the same policies, have seen their manufacturing employment grow—in some cases at the expense of U.S. jobs.

International comparisons highlight the importance of adaptability. While the rest of the world has often diversified supply chains or entered favorable trade agreements, U.S. manufacturers facing new retaliatory tariffs found themselves shut out of crucial export markets. Ultimately, the evidence suggests that a rigid, protectionist trade policy can result in significant employment losses domestically, while more open or targeted approaches may yield better long-term stability in employment and industry health.

Supply Chain Disruptions and Their Effects on Manufacturing Jobs

Perhaps the most profound impact of trade tariffs is felt in global supply chains. Because modern manufacturing is rarely contained within national borders, tariff policies can disrupt the flow of materials and components essential for production. When input costs jump due to tariffs, many manufacturers are forced to pass these costs onto consumers, compress their margins, or cut back on staffing. Delays and bottlenecks created by supply chain disruptions further jeopardize delivery schedules, straining relationships with downstream dealers and customers.

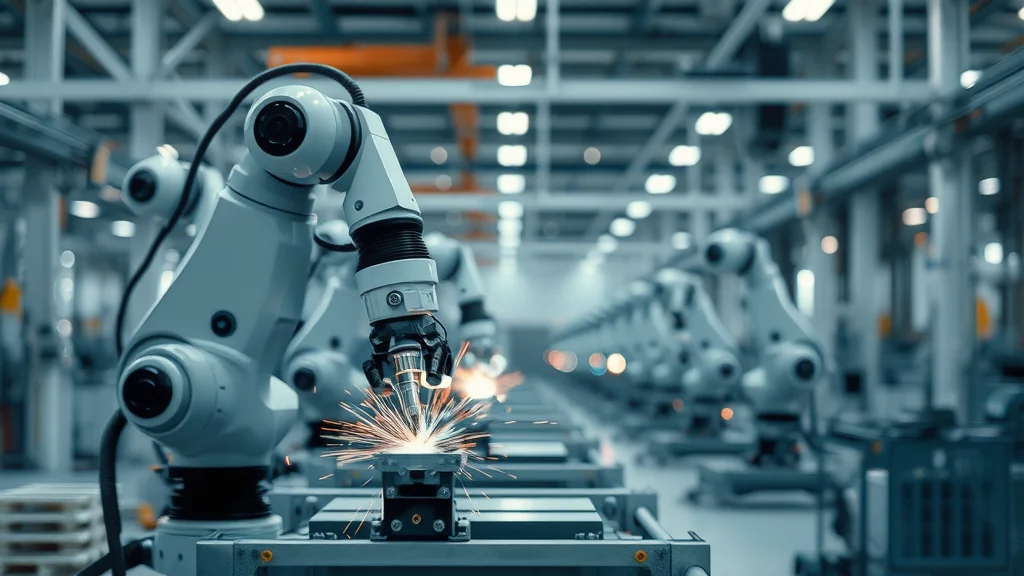

This web of challenges can lead to a vicious cycle: diminished competitiveness, falling sales, and further manufacturing job losses. Highly integrated industries—like electronics, autos, and aerospace—are often hit hardest. As factory managers scramble to identify new sourcing options or renegotiate with suppliers facing reciprocal tariffs, the complexity and potential for missteps only increase. Ultimately, unless manufacturers develop robust risk mitigation strategies, the threat of supply chain interruptions due to trade policy remains a persistent risk to both jobs and profitability.

"Tariffs don’t just alter profit margins—they redefine who stays open and who shuts their doors in manufacturing."

The Trade Deficit Dilemma: Is Protectionism Helping or Hurting?

Analysis of U.S. Trade Deficit and Its Impact on Manufacturing Employment

The U.S. trade deficit—the persistent gap between imports and exports—has been a central talking point in the debate over trade tariffs and manufacturing jobs. Supporters of protectionist policies claim that aggressive tariff hikes will spur domestic industrial growth by making imported goods less attractive. However, the numbers tell a more nuanced story. Despite tariff increases, the overall trade deficit has often remained stubbornly high, due in part to factors such as the strong dollar and American consumers' preference for global products.

For manufacturers, a growing trade deficit can increase pressure on domestic employment, especially for firms unable to compete on cost or efficiency. While select sectors (such as steel and aluminum) may experience short-term gains, the broader manufacturing sector has not consistently benefited from protectionism. Instead, retaliatory tariffs abroad have limited American exports, sometimes worsening the job outlook in export-facing industries. Ultimately, a balanced approach to trade policy—one that recognizes both the risks and rewards of globalization—is crucial for supporting sustainable manufacturing employment over the long term.

Trade Policy Shifts Under the Trump Administration

The Trump administration ushered in a new era of trade policy by prioritizing domestic manufacturing employment through a series of tariffs targeting trading partners such as China, the European Union, and North American neighbors. Arguing that prior trade deals were unfair and citing national security, the White House imposed higher tariff rates on imported goods ranging from automotive parts to consumer electronics. While these measures aimed to rebalance trade and reinvigorate the manufacturing sector, the outcomes were mixed.

Many U.S. manufacturers initially welcomed the promise of a more level playing field. However, as reciprocal tariffs were enacted and global supply chains buckled under the pressure, companies—especially those in export-heavy industries—experienced sharp declines in revenue, order flow, and new manufacturing jobs. The Trump tariffs also spurred a new round of trade negotiations, resulting in modest improvements in certain sectors but leaving the overall manufacturing employment picture uncertain. Experts caution that future policy shifts could have similarly unpredictable effects, making vigilance and adaptability essential for industry leaders.

Winners and Losers: Which Manufacturing Jobs Are Most at Risk?

Manufacturing Sectors Most Exposed to Trade Policy Changes

Not all manufacturing jobs are affected equally by changes in trade policy. Sectors heavily reliant on globally sourced raw materials—such as automotive, electronics, and machinery—are most vulnerable to tariff rate fluctuations. These industries often operate with thin profit margins, and any increase in input costs or delays from supply chain disruptions can quickly spiral into job losses, production slowdowns, or even factory closures.

On the other hand, sectors with a more domestic focus—such as food processing, construction materials, or certain textiles—may experience less volatility. However, even these businesses can be affected indirectly, as trade war escalations force suppliers and distributors to renegotiate contracts or seek alternatives overseas. The overall lesson? In today’s interconnected economy, no manufacturing segment is immune from the effects of shifting trade policy, making comprehensive risk assessment vital for every operator in the space.

Comparing U.S. and Global Manufacturing Jobs Post-Tariff

The imposition of steep tariffs by the United States has produced stark contrasts in manufacturing employment when compared to global competitors. As some American factories struggle with new input costs and retaliatory tariffs, manufacturers in Asia, Europe, and Latin America have leveraged the situation by attracting new investment and scaling up production to fill supply gaps. In some cases, multinational companies have moved entire lines or plants abroad to escape U.S. tariffs, resulting in a net loss of domestic manufacturing jobs.

This global realignment has created winners and losers on both sides of the tariff equation. While some U.S. sectors benefited from reduced foreign competition, many lost out to more agile competitors able to capitalize on new market access. For business leaders, these trends underscore the importance of tracking international trade developments and being prepared to pivot strategy in a rapidly changing landscape. Success—both on the shop floor and in the boardroom—will increasingly depend on a company’s ability to navigate global risks and opportunities in manufacturing employment.

What Small and Mid-Size Manufacturers Face in the New Era

For small and mid-sized businesses, trade tariffs present both the greatest threats and unexpected opportunities. These companies frequently lack the financial resources or scale to absorb higher tariffs, especially when it comes to sourcing specialized components. Increases in input costs can quickly erode razor-thin margins, and cash flow constraints may impede the investment needed to diversify suppliers or upgrade technology.

Yet, these manufacturers can also be more agile. Many smaller companies have thrived by quickly reshoring key processes, investing in automation, or identifying niche export opportunities protected by new trade deals. However, success demands constant vigilance—keeping a close eye on regulatory updates, participating in trade associations for early warnings, and scenario planning for policy changes. Only those companies adept at reading the winds of trade policy and acting fast stand a chance of not only surviving but thriving in the new era of global manufacturing.

Supply Chains: Outsourcing, Reshoring, and the Search for Stability

A critical response to tariff-driven risk has been the renewed focus on optimizing supply chains. Outsourcing production to lower-tariff countries or seeking new trading partners has become a favored approach for maintaining price competitiveness. However, the complications inherent to cross-border supply chains—from logistical delays to compliance issues—can expose firms to new and sometimes even greater risks.

Conversely, the reshoring movement, driven by both necessity and patriotism, has seen manufacturers bring operations back to domestic soil to evade tariffs and control quality. While reshoring can partially insulate against some forms of global volatility, it often comes with higher wage and input costs. The balancing act between outsourcing, reshoring, and building resilient, multi-source supply chains is now at the core of risk management for any business dependent on manufacturing jobs and international trade policy.

"Manufacturing jobs are not just numbers; they are lifelines for communities—tariffs can either threaten or revive them."

Do Tariffs Translate to More Manufacturing Jobs? An Opinionated Analysis

Expert Views: Do Tariffs Create or Destroy Manufacturing Employment?

Among economists and industry leaders, debate rages over whether trade tariffs ultimately help or hurt manufacturing employment. Some argue that tariffs provide crucial protection against unfair foreign competition, allowing domestic industries time to modernize, automate, and create new jobs. Others point to mounting evidence—especially post-2018—that tariffs often lead to higher production costs, retaliatory barriers abroad, and resulting net job losses in export-heavy manufacturing sectors.

In my view, the truth lies in the details. Well-targeted, temporary tariffs can support nascent industries and create a more level playing field. But blanket or poorly conceived trade barriers tend to inflict more harm than good, triggering job losses and reducing U.S. competitiveness worldwide. As such, manufacturers must remain skeptical of quick policy fixes and instead advocate for comprehensive solutions that foster both global trade relationships and robust domestic employment growth.

Long-Term Outlook: Will U.S. Manufacturing Ever Fully Recover?

While periodic waves of tariff hikes may offer short-term boosts to isolated sectors, the long-term recovery of U.S. manufacturing employment requires a more strategic approach. Sustained growth will depend on making smart investments in advanced manufacturing, embracing innovation, and cultivating adaptable supply chains. Equally important is the nation’s ability to negotiate favorable trade deals that open up export markets, foster collaboration, and blunt the negative effects of retaliatory tariffs.

The future will belong to the prepared. Businesses that proactively monitor, anticipate, and plan for shifts in trade policy will be best positioned to protect their workforce, maintain stability, and seize emerging opportunities worldwide. The call to action for every manufacturing leader is clear: Do not wait for policy clarity—invest in resilience, knowledge, and rapid response capabilities now.

Case Studies: Real-World Impacts of Trade Tariffs on Manufacturing Businesses

Midwestern Manufacturers: Stories of Unexpected Resilience

Take, for example, a mid-sized auto parts manufacturer in Ohio. When tariffs on steel and aluminum hit, the immediate expectation was for heavy layoffs or shutdowns. Instead, leadership doubled down on workforce training, implemented lean production techniques, and secured new contracts with American automakers seeking domestically sourced parts. Manufacturing employment at the plant not only survived but grew, defying the broader trend.

Similar resilience stories abound across the Midwest and South, where legacy manufacturers paired innovation with adaptability. The key? Proactive risk assessment of global supply chains, engagement with labor unions on productivity initiatives, and rapid pivoting to serve markets less affected by the trade war. While not every business has succeeded, those that did have become models for community revitalization and reindustrialization amid global uncertainty.

Small Business Spotlight: Navigating New Tariff Realities

For a small electronics assembler in Texas, the introduction of tariffs on imported components forced a dramatic rethink of sourcing, pricing, and customer engagement. By investing in digital transformation—automating order management, diversifying suppliers, and educating their existing workforce—the company weathered the policy storm and even increased profitability. The lesson for small manufacturers is clear: Agility and a willingness to innovate are often the deciding factors between prosperity and insolvency when trade policy shifts unexpectedly.

Mitigating the Risks: How Manufacturers Can Prepare for Trade Policy Changes

- Assess your global supply chain and identify vulnerabilities: Map out all suppliers, pinpoint those most exposed to tariff hikes, and create action plans for each.

- Build flexibility and diversify suppliers: Avoid sole-sourcing; establish relationships with backup suppliers in low-tariff or domestic markets.

- Stay ahead of regulatory and trade policy updates: Designate a team or partner with experts who can monitor policy changes in real-time.

- Active scenario planning for manufacturing employment shifts: Model different tariff scenarios to estimate impact on staffing, production, and profitability, allowing you to react swiftly to changes.

| Preparation Step | Action Item | Responsible Team |

|---|---|---|

| Supply Chain Audit | Review all materials for tariff risk | Procurement |

| Supplier Diversification | Vet alternate suppliers in new regions | Operations |

| Policy Monitoring | Subscribe to trade policy alerts | Compliance |

| Scenario Analysis | Conduct quarterly impact assessments | Finance/HR |

"Manufacturers who adapt quickly to trade policy turbulence are best positioned for long-term growth."

People Also Ask About Trade Tariffs and Manufacturing

How do trade tariffs affect manufacturing jobs?

Trade tariffs directly impact manufacturing jobs by raising the cost of imported materials and components, which can lead to higher production costs for factories. When these costs cannot be absorbed or passed on to consumers, manufacturers may be forced to reduce staffing, automate operations, or relocate production to countries with fewer trade barriers. Ultimately, persistent or unexpected tariff increases can result in significant job losses across the manufacturing sector, particularly in industries that rely on complex global supply chains.

What industries are impacted the most by trade tariffs?

Industries most affected by trade tariffs are those heavily dependent on internationally sourced raw materials or components, such as automotive manufacturing, electronics, machinery, and aerospace. Additionally, sectors with substantial export activity can be hit hard if foreign governments respond with retaliatory tariffs. The impact is amplified in industries where profit margins are tight, making it difficult to absorb even small increases in input costs or disruptions in the supply chain.

Do trade tariffs increase or decrease manufacturing employment?

While the intention of tariffs may be to increase domestic manufacturing employment by curbing foreign competition, the actual effects are mixed. Some sectors may see short-term job gains, especially those protected from imports, but most research shows a net decrease in manufacturing employment over time due to higher costs, retaliatory measures, and global market realignments. The most sustainable way to support manufacturing jobs is through smart trade policy and targeted investment, rather than broad tariff increases.

Can manufacturers avoid the impact of trade policy changes?

It is difficult for manufacturers to completely avoid the impact of trade policy changes. However, they can significantly reduce their risk by diversifying suppliers, building flexible supply chains, and closely monitoring policy trends. Investing in technology, automation, and scenario planning can also boost resilience and enable quicker adaptation when trade policy shifts suddenly. Staying ahead of potential disruptions is a continuous process requiring proactive leadership and investment.

Frequently Asked Questions on Trade Tariffs and Manufacturing

- What are trade tariffs? — Tariffs are taxes imposed on imported goods, designed to regulate international trade and protect domestic industries.

- How do tariffs work in the context of international trade? — They increase the price of imported goods, making domestic alternatives more attractive but can trigger retaliatory tariffs from trading partners.

- What was the effect of Trump administration tariffs on U.S. manufacturing? — The Trump administration's tariffs led to a mixed bag: some sectors saw temporary job growth, but others suffered layoffs, higher input costs, and supply chain disruptions.

- How can supply chain diversification mitigate tariff risks? — Diversifying supply sources across regions or using domestic suppliers reduces dependency on any one country, lessening the impact of sudden tariff changes or trade conflicts.

Key Takeaways: Is Your Manufacturing Business at Risk From Trade Tariffs?

- Trade tariffs and manufacturing remain deeply intertwined in today’s global economy.

- Manufacturing jobs are sensitive to policy changes and supply chain shocks.

- The next era of trade policy demands proactive strategies from manufacturers.

Final Opinion: Are You Ready for the Next Wave of Trade Tariffs and Manufacturing Shifts?

"Ignoring global trade trends can threaten your manufacturing business; but with vigilance and strategy, risk can become opportunity."

In my opinion, the time for preparation is now. Manufacturers who embrace change, build resilient supply chains, and stay fully informed will not only survive in a turbulent world—they will thrive and lead the next generation of global industry.

Stay Ahead: Subscribe for the Latest on Trade Tariffs, Reshoring, and Supply Chain Changes

Manufacturer, don't miss out! Stay informed on global trade shifts—tariffs, reshoring, and supply chain updates could reshape your strategy. Subscribe to Global Trade News for the latest updates. Call 203-271-7991 today.

Recent developments in trade policy have significantly impacted the manufacturing sector, with tariffs playing a central role. For instance, the U.S. Chamber of Commerce highlights that increased steel and aluminum tariffs have led to higher costs for U.S. manufacturers, reducing their global competitiveness. (uschamber.com) Additionally, a study by the National Bureau of Economic Research indicates that tariffs may have reduced labor productivity in manufacturing by weakening import competition and inducing the entry of smaller, less productive domestic firms. (nber.org) These insights underscore the complex relationship between trade tariffs and manufacturing, emphasizing the need for businesses to stay informed and adaptable in a fluctuating trade environment.

Add Row

Add Row  Add

Add

Write A Comment