Did you know that global tariff rates on manufacturing inputs have surged by over 25% since 2018, shaking up everything from consumer prices to supply chains? As manufacturers wrestle with unpredictable costs and policy shifts, the impact of tariff decisions is being felt faster—and more painfully—than ever before. In this timely opinion article, we break down what these changes mean for leaders, strategists, and consumers alike, so you can adapt in a landscape where every trade deal, reciprocal tariff, and policy adjustment echoes worldwide.

A Startling Look at Manufacturer Tariff Impacts Today

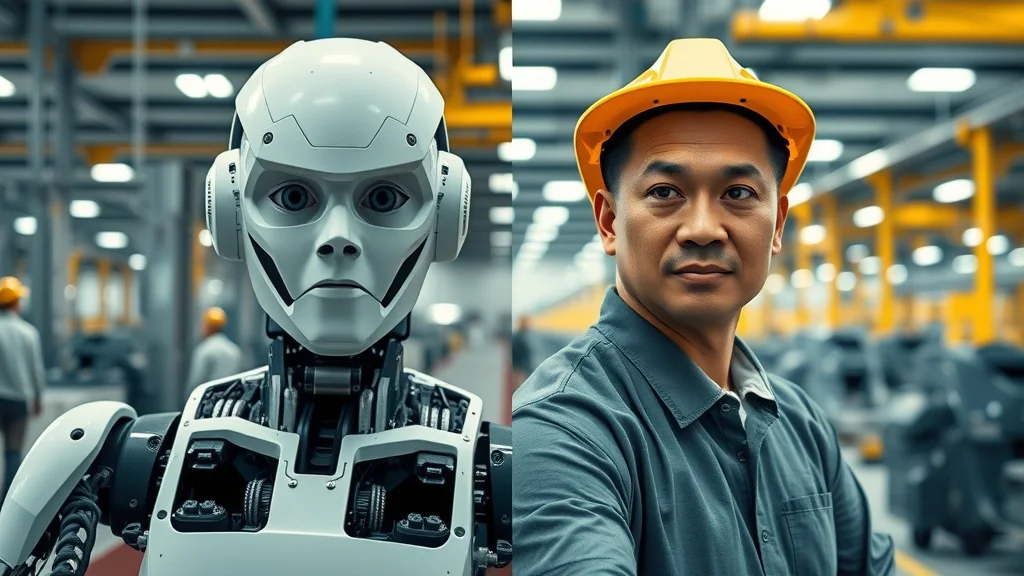

Across the globe, manufacturers are grappling with a new era of volatility. The impact of tariff policies—set by governments from the United States to China—has grown more dramatic with every tariff increase and retaliatory measure. Higher tariff rates, unpredictable trade deals, and costlier imports have slashed profit margins, complicated production planning, and fueled consumer price increases on everything from cars to electronics. It’s not just a boardroom issue anymore: tariff hikes now affect every link in the supply chain, driving up raw material costs, influencing labor decisions, and determining whether companies offshore or reshore their operations.

This seismic shift isn’t just about big headlines. For every major policy announcement—whether from the White House or global trading partners—there are thousands of secondary and tertiary impacts affecting smaller manufacturers, logistics teams, and, ultimately, everyday consumers. As tariffs imposed on key imported goods reverberate globally, manufacturers are forced to adjust on the fly, making this one of the most consequential periods for global trade in recent memory.

What You’ll Learn About Manufacturer Tariff Impacts

- Understand how current tariff rates affect manufacturers

- Learn why consumer prices are impacted

- Identify key trends shaping the impact of tariff

- Discover how leading manufacturers adapt strategy

- Explore expert opinions on long-term outcomes

Understanding Manufacturer Tariff Impacts: Setting the Stage

To grasp the full spectrum of manufacturer tariff impacts, it’s crucial first to understand what drives recent tariff rate changes and which regions and goods are affected the most. Since the trump administration undertook sweeping renegotiations with major trading partners beginning in 2018, reciprocal tariffs, tariff hikes, and evolving tariff policy have become the new normal. The United States, for instance, imposed tariffs on steel and aluminum imports, prompting retaliation from trading partners and creating a domino effect throughout global trade networks.

Today, the primary drivers of tariff rate changes are geopolitical tensions, the quest for fairer trade deals, and the need to protect domestic industries. Asia, North America, and Europe are the major exporting regions most affected by these shifts, especially in automotive, electronics, consumer goods, and industrial machinery. Understanding how tariff costs and sudden tariff rate adjustments affect these sectors is key for anticipating supply chain disruptions, rising consumer prices, and long-term strategic pivots that manufacturers must make to maintain competitiveness.

- Key drivers of 2024 tariff rate changes: Geopolitical shifts, supply chain disruptions, new trade deals, and retaliatory tariffs

- Major exporting regions affected: Asia (especially China), North America (US, Canada, Mexico), Europe (Germany, UK)

- Types of manufacturer goods most impacted: Automotive, Electronics, Consumer goods, Industrial machinery

Digging Deeper: How Tariff Rates Directly Influence Manufacturer Tariff Impacts

Comparing Historical and Current Tariff Rates

The narrative surrounding tariff rates is not just about numbers; it’s about trajectory and magnitude. Only five years ago, manufacturers in the United States operated under a relatively stable tariff policy, with rates on imported goods hovering near historic lows. Today, data paints a starkly different picture: not only have tariff rates for some sectors—such as steel and aluminum—more than doubled, but the volatility around these numbers has become a core business risk. Each move—whether a reciprocal tariff, retaliatory tariff, or sudden tariff hike—ripples across global supply chains, affecting everything from tariff cost calculations to contract negotiations.

For example, the average import price on key manufacturing inputs jumped after the Trump administration’s 2018 steel and aluminum tariffs, and further escalated with subsequent tariff increases on electronics and consumer goods. These deeper costs aren’t always visible at the store level, but their effect is heard loud and clear in boardrooms and on factory floors. Consider the difference in manufacturer tariff impacts when a company sourcing raw materials now faces a 20% cost increase overnight—the margin squeeze is real, persistent, and strategic decisions must respond immediately.

| Year | Industry | Avg. Tariff Rate (%) | Manufacturer Cost Increase (%) |

|---|---|---|---|

| 2018 | Automotive | 2.5 | 1.5 |

| 2019 | Electronics | 4.2 | 3.0 |

| 2021 | Consumer Goods | 6.0 | 5.2 |

| 2023 | Industrial Machinery | 7.5 | 6.8 |

| 2024 | Steel & Aluminum | 12.2 | 10.5 |

Which Manufacturer Sectors Bear the Brunt of Tariff Rate Shifts?

Not all manufacturing sectors are impacted equally by volatile tariff rates. The greatest pain points are felt in industries where global supply chains cross multiple tariff checkpoints or where alternate sourcing is limited. The automotive sector, for instance, heavily relies on imported steel, aluminum, and key electronic components—so every reciprocal tariff or tariff increase is magnified through its deep supplier base. Likewise, electronics & consumer goods producers, facing tariffs on both raw materials and finished parts, are forced to either innovate quickly or absorb bottom-line losses.

Industrial machinery companies, often exporting globally, must simultaneously manage shifting tariffs and trade rules and navigate the uncertainty around import prices for precision components. As a snapshot, here’s a look at which sectors are currently feeling the greatest pressure:

- Automotive

- Electronics

- Consumer goods

- Industrial machinery

Quotes: Industry Perspectives on Tariff Rate Volatility

"We saw a 20% increase in component costs overnight due to sudden tariff rate adjustments." – CEO, Mid-Sized Manufacturer

Impact of Tariff on Manufacturer Strategy and Operations

Reshoring vs. Offshoring: Manufacturer Dilemmas Amid Tariff Rate Fluctuations

When tariff policy shifts overnight, manufacturers face a fundamental dilemma: bring production home or double down on offshoring? Reshoring is increasingly tempting as prolonged tariff cost exposure chips away at profits and threatens just-in-time supply chains. However, the path isn’t always clear. Domestic labor costs and resource constraints present real challenges, even as higher tariffs on imports make foreign-sourced goods less attractive. Forward-thinking manufacturers are analyzing the entire cost structure—beyond tariff rates and import prices—to build resilient, future-ready operations.

This debate is amplified by recent tariffs imposed on strategic products by the United States and its trading partners, resulting in a delicate balancing act. Offshoring remains viable for some, especially where expertise, raw material access, or economies of scale are critical. Yet, for many, the unpredictability of today’s tariffs and trade environment makes reshoring seem like a strategic safeguard, even when short-term costs rise. The direction a company chooses as a response to manufacturer tariff impacts governs its competitiveness and longevity in a volatile global marketplace.

Supply Chain Disruptions Linked to Manufacturer Tariff Impacts

There’s no escaping the supply chain turmoil sparked by ongoing tariff hikes on imported goods. Each fresh round of tariff increases creates a ripple effect: manufacturers not only see import price hikes on critical components, but must also deal with shipment delays, inventory pile-ups, and rapidly shifting logistics strategies. These disruptions often force manufacturers to quickly diversify suppliers, build up inventory “just in case,” or even reroute shipments through alternative trading partners to avoid punitive tariffs.

Today’s supply chain leaders must scrutinize every tariff cost and consider alternate pathways for shipping, warehousing, and supplier relationships. The goal: minimize disruption, retain flexibility, and shield both margins and end customers from volatile consumer price shifts. Here are the most common disruptions linked to manufacturer tariff impacts:

- Delayed shipments

- Supplier diversification

- Inventory build-up

- Shift in logistics hubs

Follow a team of logistics managers and engineers as they respond to a sudden tariff rate change, brainstorming and rapidly adjusting supply routes. Dynamic sequences from digital command rooms to bustling shipping docks reveal how quick action is critical for survival.

How Manufacturer Tariff Impacts Trickles Down: The Cost to Consumer Prices

Tracing the Path From Tariff Rate to Consumer Prices

Every shift in tariff rates sets off a domino effect that ultimately lands at the checkout counter. When manufacturers face a tariff increase or a spike in tariff cost on their raw materials and parts, they’re faced with a tough choice: absorb the losses or pass them onto consumers as higher consumer prices. While some large companies have the scale to swallow losses temporarily, most need to strike a balance—raising retail consumer price tags just enough to maintain margins without killing demand. The result? Sticker shock for consumers and a challenging retail landscape for resellers and brands alike.

These increases aren’t uniform—electronics, vehicles, and home appliances bear outsized brunts, given their global supply chains and reliance on imported goods. Retailers try to soften the blow, but in the end, the new reality is higher import prices and, consequently, elevated consumer prices. As trade deals and tariff policy become more unpredictable, the likelihood of “price surprises” only grows.

Sector Case Studies: Major Consumer Price Surges

- Electronics: Up 12%

- Vehicles: Up 8%

- Appliances: Up 10%

Expert View: Navigating Consumer Price Pressures

"Consumers are feeling the pinch, but manufacturers face the tougher decision—absorb costs or pass them along?" – Trade Policy Analyst

Watch insights on how supply chain disruptions and shifting tariff policies impact everyday prices, and learn how leading brands are explaining price increases to their customers in real time.

Opinion: Long-Term Risks and Opportunities — The True Impact of Tariff for Manufacturers

Potential Risks from Persistent Manufacturer Tariff Impacts

- Profit margin squeeze

- Reduced global competitiveness

- Increased regulatory unpredictability

Persistent swings in tariff rates inflict more than temporary pain. Over time, profit margins shrink, especially for those unable or unwilling to adjust their cost structures swiftly. There’s also the threat of falling behind global competitors who gain easier access to tariff-free markets. When combined with the uncertainty baked into the current tariff policy landscape, these risks become existential. Manufacturers that fail to future-proof their operating models will find the enduring impact of tariff decisions especially punishing.

Opportunities Emerging from Manufacturer Tariff Impacts

- Innovation in sourcing

- Strategic partnerships

- Expansion into tariff-free markets

Yet, turbulence brings opportunity. Forward-leaning manufacturers are using the impact of tariff to drive core strategic change. Many are tapping into innovation—exploring new raw material sources, deepening relationships with partners in tariff-exempt countries, and investing in robust data systems for real-time supply chain oversight. Strategic partnerships are blossoming between companies, fueling collaborative sourcing and logistics. Those willing to pivot and innovate can actually expand into new, less volatile markets and emerge even stronger after the dust settles.

Quote: Future-Proofing Against Manufacturer Tariff Impacts

"Adaptability isn’t optional—it’s survival. Manufacturers must innovate or risk obsolescence." – Global Trade Consultant

People Also Ask: Your Questions on Manufacturer Tariff Impacts Answered

How do tariff rates affect the global supply chain for manufacturers?

Tariff rate changes ripple through global supply chains by increasing import prices on raw materials and parts. This often leads manufacturers to re-evaluate their sourcing strategies, shift logistics hubs, or diversify suppliers. Disruptions can slow shipments, create inventory surpluses, and force rapid redesigns of supply networks. Over time, persistent tariff volatility pushes companies to develop more agile, resilient supply chains—sometimes even reshoring operations or seeking new international partners to maintain a competitive edge.

Why have consumer prices risen in industries affected by manufacturer tariff impacts?

Industries that rely on imported goods or components see higher operational costs whenever tariff rates climb. Since manufacturers must either absorb these costs or pass them on, the most common outcome is an increase in consumer prices. Sectors like electronics, vehicles, and appliances are especially vulnerable, because they source from complex, global supply chains that are highly sensitive to even slight tariff hikes. As a result, shoppers encounter price increases and fewer discounts, making purchasing choices more challenging.

Can manufacturers adapt to fluctuating tariff rates, and how?

Adaptation is not just possible—it's essential. Manufacturers can cope with volatile tariff rates by diversifying their supplier base, leveraging new technologies for demand forecasting, and building buffer inventories where feasible. Some companies form strategic partnerships with logistics firms or look for local sourcing options to reduce dependence on unpredictable trade partners. Investment in advanced analytics helps detect tariff risk early, empowering proactive action rather than costly, last-minute responses.

Key Takeaways: Navigating Manufacturer Tariff Impacts

- Tariff rates reshape manufacturer strategies

- Consumer prices rise as a ripple effect

- Manufacturers must be agile to survive

- Long-term innovation is crucial to new opportunities

FAQs: Manufacturer Tariff Impacts Explained

What are manufacturer tariff impacts?

Manufacturer tariff impacts refer to the range of effects triggered by changes in tariff policy, including higher costs for imported goods, shifting supply chain strategies, and price increases for finished products. These impacts influence manufacturer profits, consumer prices, and competitive positioning in global trade.

Are certain countries exempt from major tariff impacts?

Some countries have negotiated trade agreements that provide exemptions or reduced tariff rates on specific categories of imported goods. However, high-impact markets—such as the US, China, and EU—often use tariffs to exert leverage in trade talks, limiting broad exemptions. Recent moves toward regional trade deals mean exemptions are frequently sector- and product-specific.

What’s the difference between tariff rate and tariff rates in current trade policy?

A "tariff rate" usually refers to the specific percentage tax levied on a particular imported product. "Tariff rates," in the plural, describe the landscape of percentages applied across multiple product categories or geographies. Both have become highly variable under modern trade policy, prompting close scrutiny by manufacturers managing global supply chains.

Tables: Data-Driven Insights on Manufacturer Tariff Impacts

| Year | Industry | Avg. Tariff Rate (%) | Manufacturer Cost (+%) | Retail Consumer Price (+%) |

|---|---|---|---|---|

| 2018 | Electronics | 2.5 | 1.1 | 1.8 |

| 2020 | Vehicles | 4.7 | 3.6 | 4.2 |

| 2022 | Appliances | 6.9 | 5.3 | 6.2 |

| 2023 | Steel & Aluminum | 10.3 | 8.0 | 9.0 |

| 2024 | Industrial Machinery | 11.2 | 9.5 | 10.1 |

Conclusion: The Road Ahead for Manufacturer Tariff Impacts

The impact of tariff on manufacturers is real and still evolving. Agility, data-driven planning, and innovative sourcing are the keys to thriving through continuing trade volatility.

Stay Ahead: Get the Latest on Manufacturer Tariff Impacts

Manufacturer, don't miss out! Stay informed on global trade shifts—tariffs, reshoring, and supply chain updates could reshape your strategy. Subscribe to Global Trade News for the latest updates. Call 203-271-7991 today.

The landscape of manufacturing is undergoing significant shifts due to recent tariff policies. For instance, the article “Manufacturing in the Tariff Era” by the Manufacturers Alliance provides an in-depth analysis of how tariffs are affecting manufacturers, highlighting increased compliance costs and operational challenges. (manufacturersalliance.org) Additionally, “Looking Ahead: The Impact of Tariffs on Manufacturing Businesses” by Baker McKenzie explores the broader implications of tariffs, including supply chain disruptions and strategic considerations for businesses. (bakermckenzie.com) If you’re serious about understanding and navigating the complexities of current tariff impacts, these resources will offer valuable insights and guidance.

Add Row

Add Row  Add

Add

Write A Comment