Did you know tariffs introduced during the US China trade war have cost the average American household $580 annually? This seismic economic standoff doesn't just hit governments and big business—it quietly drains your wallet every trip to the store. Let's unpack what this means for you, how we got here, and why it will likely shape the price tag on everything from your next smartphone to a box of cereal.

A Startling Snapshot: The US China Trade War in Numbers

The US China trade war is not just a matter for policymakers and corporate executives; its implications reverberate throughout the economy, significantly influencing the day-to-day lives of American consumers. Since the initial tariffs in 2018, more than $500 billion worth of goods have been affected. The United States and China remain the world’s largest economies, connected by a vast web of trade—until tariffs, retaliatory taxes, and policy shifts started to unravel decades of global supply chains. Directly or indirectly, these actions have led to an increase in the cost of household goods, technology, and even automobiles.

"Tariffs introduced during the US China trade war have cost the average American household $580 annually." – Institute for International Economics

For every number mentioned in trade headlines, there’s a ripple felt in the real world. For example, economists have traced rising prices of essentials—like smartphones, TVs, and appliances—to these new barriers. With import tariffs on Chinese goods reaching as high as 25%, the pressure is passed from businesses to end consumers. What stands out is not just the billions at stake for the United States, but the way the trade war constrains product availability, spurs inflation, and forces companies to make drastic supply chain pivots, with lasting impact on the cost of living.

What You'll Learn About the US China Trade War's Impact

- How the US China trade war changes the price of household goods

- The role of rare earths and supply chain disruptions

- Expert opinions on the future of the US China trade war

- Key events, policy shifts, and what to watch for global trade

Understanding the US China Trade War: An Opinionated Overview

Defining the US China Trade War and Key Events

The US China trade war kicked off officially in 2018 when the Trump administration imposed hefty tariffs on hundreds of billions of dollars’ worth of Chinese goods, blaming the rising trade deficit and alleged unfair china trade practices such as forced technology transfers and lack of reciprocal market access. China, led by President Xi Jinping, retaliated with tariffs of their own, sparking a tit-for-tat escalation. Not just an economic contest, the trade war has become a chess match of strategic national priorities. Intellectual property theft, state subsidies for Chinese companies, and accusations of dumping goods below cost only deepened mistrust. The resulting regulatory tangle has altered international trade patterns—global supply chains have shifted, with some manufacturers moving production to countries like Vietnam or Mexico to dodge tariffs.

Key milestones include rounds of negotiations yielding the Phase One Trade Deal in January 2020, promises for Beijing to purchase more US goods, and ongoing disputes over compliance. Influential moments such as the blacklisting of Chinese tech giants and the use of export controls pushed the conflict beyond goods—it’s a struggle for technological dominance and national security, deeply influencing both the united states and global commerce.

The Rise of Tensions Between the United States and China

The roots of the trade war run deeper than a squabble over tariffs. The economic rivalry reflects long-standing unease about China’s rapid industrial ascent, state-directed capitalism, and ambitions in next-generation technologies—from AI to rare earths and electric vehicles. As the United States sought to curb China’s industrial ambitions through punitive tariffs and stricter oversight of Chinese investments, mutual suspicion reached new highs. American lawmakers cite national security and the safeguarding of intellectual property as fundamental drivers, while Chinese authorities paint the measures as containment aimed at slowing their rise.

This climate of distrust is bolstered by social media narratives, trade deficit statistics, and sensational headlines that can sometimes exaggerate the perceived threat or benefits of action. For both Washington and Beijing, these maneuvers are as much about domestic politics and global image as they are about economics. The result? A lasting, multilayered standoff that impacts everything from stock prices to the cost of your next electronic device.

The Trade War’s Ripple Effect: Your Wallet and the Economy

The most tangible effect of the us china trade war appears at the checkout line. Average Americans pay more for household items—not just electronics, but everyday goods like clothing, furniture, and groceries. Higher import tariffs on Chinese goods act as hidden taxes, baked into the cost of almost everything in your shopping cart. Companies facing costlier supplies often have no alternative but to pass these expenses along, especially in sectors tightly linked to Chinese manufacturing.

Price Changes at the Consumer Level Due to the US China Trade War

Take a look at price changes before and after the imposition of tariffs. Goods such as laptops, smartphones, washing machines, and even toys have seen prices surge by anywhere from 5% to 25%. Retailers and electronics manufacturers cite the elevated cost of rare earths—vital for everything from computers to electric vehicles—as a major hurdle. The inflating of prices doesn’t stop at gadgets; tariffs on raw materials ramp up production costs, ultimately impacting the final sales price. For families, this translates into smaller shopping baskets and less flexibility in budgets, further aggravated during periods of broader economic uncertainty or inflation.

"The real cost of the trade war lands squarely on the consumer." – Trade Policy Analyst

Even after some early relief for select goods following the Phase One Trade Deal, consumers are still reeling from the cumulative effects, seeing fewer promotions or discounts, and tighter product selections in stores wary of inventory risk.

Inflation and the Cost of Imported Goods in the United States

Beyond specific tariffs, the pervasive fear and uncertainty of the trade war have stoked inflation, as supply chain disruptions make sourcing products less predictable and more expensive. Companies importing electronics, apparel, or parts from China are forced to renegotiate contracts or seek new suppliers. These added costs are rarely absorbed by large retailers or distributors—instead, they funnel down to the consumer in the form of price hikes and, sometimes, lower quality. Imported goods now carry premiums driven not only by tariffs but also by the logistics of rerouting supply chains and sourcing alternatives from outside China, often at higher prices.

As grocery and electronics bills swell, so do underlying economic anxieties. Inflation’s impact is not uniform—lower-income households, spending a greater portion of their income on basic goods, are more acutely affected, straining household budgets and further polarizing economic outlooks.

How American Businesses Adapt to the China Trade Dynamic

American industries have responded with a variety of tactics. Some large corporations accelerate automation and explore reshoring—bringing production back to the United States—to manage their exposure to foreign trade policies and reduce dependence on Chinese supply chains. Others diversify their supplier base, seeking partners in Southeast Asia, South Korea, or Mexico. However, these adaptations rarely offer a quick fix; moving operations is expensive, time-consuming, and fraught with logistical hurdles.

Meanwhile, small and mid-sized manufacturers face tough choices: absorb higher costs, pass them to consumers, or risk shrinking profit margins. Some industries, like auto manufacturing and consumer electronics, are especially vulnerable, reliant on components produced in China with few substitutes. The delicate balancing act highlights the broader cost to innovation and competitiveness in the global marketplace.

| Product Category | Pre-Trade War Tariff Rate | Post-Trade War Tariff Rate | Average Price Increase (%) |

|---|---|---|---|

| Consumer Electronics | 2.5% | 15% - 25% | 10-20% |

| Apparel & Footwear | 11% | 25% | 7-12% |

| Automobiles & Parts | 2.5% | 25% | 5-10% |

| Appliances | 2.5% | 10-25% | 12-17% |

| Toys | 0% | 7.5-15% | 6-12% |

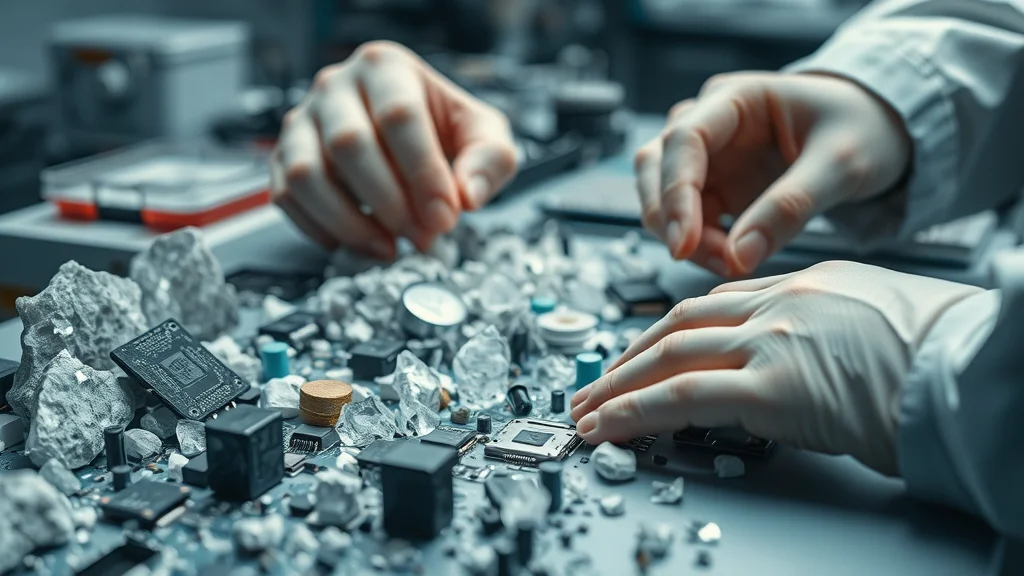

Rare Earths and Supply Chain Shocks from the US China Trade War

The us china trade war has exposed a critical vulnerability in global manufacturing—the heavy reliance on China for rare earths. These minerals, indispensable in making everything from smartphones and magnets to electric vehicle batteries and fighter jets, have become a focal point in the standoff. China controls about 80% of the world’s supply, meaning export controls or interruptions send shockwaves through industries worldwide. The push for national security is not simply about tariffs but safeguarding access to these "critical materials" essential in tech innovation and defense.

Why Rare Earths Matter: Technology, Defense, and the Economy

Rare earth minerals are the backbone of modern technology and defense—found in everything from iPhones and LED screens to stealth aircraft and guided missiles. The united states, despite having some resources, remains deeply dependent on Chinese extraction and refining. This strategic disadvantage makes access to rare earths as important as access to oil was in earlier decades. Disruptions in this market don't just cause price increases; they can also slow down production lines, create shortages, and spark investment in domestic mining or alternative technologies.

Both the American government and private sector increasingly prioritize reducing reliance on Chinese supply chains for these materials. New investments in rare earth mining within US borders and trade partnerships with other countries are part of a broader push to secure economic and national security interests.

US China Trade War’s Impact on Supply Chains

Supply chains spanning decades and continents have been tested like never before. The us china trade war has forced companies to revisit sourcing strategies, as their traditional suppliers in China suddenly became costlier or riskier. From electronics manufacturers to automakers, businesses have had to diversify, often turning to South Korea, Vietnam, or local US facilities for critical parts. However, building new supply networks isn’t easy; it often results in higher short-term costs, fragmented logistics, and delays in product launches.

For consumers and manufacturers alike, the outcome is a new "normal" of prolonged uncertainty. This trend has accelerated discussions about "reshoring" and the strategic rebalancing of supply chains, making resilience as important as cost-efficiency going forward.

Export Controls and Their Consequences for Rare Earths

The imposition of export controls by both the United States and China has added complexity to already strained supply routes. Washington’s blacklisting of certain chinese companies and restrictions on exporting sensitive tech have been met with similar threats from Beijing—potentially limiting American access to Chinese-mined rare earth minerals. Each round of restrictions triggers confusion and price spikes, causing manufacturers to scramble for alternative suppliers or increase safety stock, further driving up costs. This battle for resource security highlights a new dimension of the trade war: exporting influence through the trade in critical materials as a tool of economic coercion.

The unpredictable nature of tit-for-tat export controls means that businesses investing in new technologies or next-generation products must build robust strategies to hedge against sudden policy shifts or supply shocks—a daunting prospect for firms across the globe.

Case Study: Electronics and Auto Manufacturing in the United States

The electronics and automobile industries illustrate the blunt force of these pressures. Well before the trade war, these sectors relied on cost-efficient, just-in-time delivery of parts from Chinese factories. The imposition of tariffs and rare earth shortages has eroded profit margins, slowed innovation, and at times resulted in job cuts. Some carmakers, eager to introduce electric vehicles, have contended with longer timelines and higher costs due to bottlenecks in rare earth supplies and battery components. Similarly, electronics giants face challenges in securing reliable, affordable inputs for everything from laptops to medical devices.

Both industries offer a cautionary tale: navigating an uncertain trade landscape now requires flexibility, foresight, and willingness to rethink old habits for the sake of resilience and long-term competitiveness.

Policy Maneuvers: Trump Administration, Xi Jinping, and Trade Deals

Perspectives on the Trump Administration’s Approach to the Trade War

The trump administration, under President Donald Trump, shifted US economic policy sharply toward confrontation with China. Tariffs were leveraged as a tool for compelling change in Chinese economic behavior, including reducing forced technology transfers, opening Chinese markets to US firms, and addressing the persistent trade deficit. Critics, however, argue that tariffs act as a tax on the American consumer and fail to address China’s distinctive state-driven strategy. Supporters believe tough measures were overdue given years of unreciprocated Chinese trade practices and undermining of global norms.

The unpredictability of the Trump administration’s negotiating style—involving abrupt tweets, threats of further escalation, and last-minute concessions—created frequent volatility in global markets. The Phase One Trade Deal offered some relief in the form of increased Chinese purchases of US agricultural goods, but deeper structural issues linger, suggesting the trade war is far from over.

Xi Jinping’s Trade Strategy and National Security Goals

China, under xi jinping, responded to US tariffs with strategic countermeasures and rhetoric stressing national unity in the face of foreign pressure. The Chinese leader’s vision ties economic modernization to national security, emphasizing technological self-sufficiency, domestic production of critical goods, and the mobilization of state resources to weather trade disruptions. Xi’s government has promoted "dual circulation"—strengthening domestic consumption while retaining key global trade relationships—to soften the blow from lost US exports.

Xi Jinping’s approach positions the trade war as a broader contest of influence, not only with the United States but with the world. By tightening the Chinese government’s grip on strategic sectors and investing in next-generation tech, Beijing is making a long-term play for technological supremacy.

Analyzing Major Trade Deals Between the United States and China

Trade negotiations between the two superpowers have swung from deadlock to apparent breakthroughs and back again, producing mixed results. The most notable agreement—January 2020’s Phase One Trade Deal—committed China to increase purchases of US goods and tighten protections for intellectual property rights. While implementation has been uneven, it marked an attempt to move beyond spiraling escalation.

However, many contentious issues remain unresolved: continued export controls on advanced technologies, ongoing disputes over market access, and perennial concerns over compliance and transparency. Each attempt at détente tests the limits of international negotiation and reinforces the idea that the trade war is not a single event, but an evolving saga.

"China’s long-term strategic play involves more than just tariffs; it’s about technological dominance." – Senior Fellow, Asia Program

Global Consequences: The US China Trade War in East Asia and Beyond

South Korea’s Response and Economic Adjustments

Few regions have felt the aftershocks of the us china trade war as acutely as east asia. As China and the United States tangled, South Korea emerged as a pivotal player, adapting quickly to the evolving environment. Korean manufacturers, sensing opportunity in the supply chain reshuffle, expanded capacity in critical sectors—like chipmaking and display technologies—aiming to fill the void left by curtailed China-US trade. The South Korean government deployed incentives and support for local industries, supplying parts and equipment to both sides to stay relevant in a staggered regional marketplace.

This nimbleness has paid dividends: South Korean exports to the United States and other markets have surged, as global buyers seek alternatives to China. However, these benefits are counterbalanced by turbulence in other sectors, where export controls and global uncertainty have suppressed investment and complicated logistics. The trade war, for Korea, delivered both disruption and new opportunities—and revealed how small shifts in policy can shape entire regional economies.

How East Asia’s Supply Chains Were Redefined

The trade war has fundamentally redrawn economic maps in east asia. When US tariffs hit Chinese goods, regional manufacturing activity started to move to countries like Vietnam, Thailand, and Malaysia. Japanese and Taiwanese firms also shuffled investments southward to mitigate risk and sidestep new duties. This pivot not only creates new winners and losers but also alters the traditional balance of trade in the region.

The interdependence built up over decades between China and its neighbors is now under strain. New supply chains are more diversified, but also more complex and costly to manage. Smaller economies stand to benefit from new jobs and investment, while larger players must continually adapt to fresh policy challenges and market dynamics.

United States and China: Setting the Stage for the Next Trade War?

Despite occasional ceasefires, tensions between the united states and china remain high. As both sides double down on industrial policy, decoupling technology, and bolstering strategic sectors, the risk of another round of economic hostilities looms. Policy shifts in Washington and Beijing often serve domestic political goals but have outsized effect globally, fueling speculation about the "Trade War 2.0" or even broader global economic conflict.

Some experts argue the next phase will focus less on tariffs and more on control over critical tech, rare earths, and digital infrastructure—giving the world a preview of a new kind of trade contest, where rules are written not only by economic logic but by evolving definitions of national security and technological leadership.

Who Benefitted from the US-China Trade War?

Winners and Losers: The United States, China, and Other Global Players

The scorecard for the us china trade war isn’t neatly divided between the United States and China. American farmers and manufacturers exposed to disrupted global supply chains faced challenges as retaliatory tariffs slashed demand for their products, leading to billions of dollars in government aid to offset losses. Conversely, some countries in Southeast Asia and Mexico became unexpected winners, capturing manufacturing investment bolting from China. Meanwhile, consumers in both countries—especially those with less economic power—mostly lost out, paying higher prices for essential goods.

Some US tech and defense industries, wary of relying on Chinese components, found new opportunities in domestic reinvestment and national security contracts. Chinese exporters to Europe or developing markets also adjusted, sometimes deepening their global ties as a hedge against the unpredictability of US demand. The overall lesson: in a war defined by moving targets, advantages have often been fleeting and unevenly distributed.

Opinion: Did Tariffs Actually Shift Jobs Back to the United States?

Tough talk and periodic announcements of new "reshoring" projects suggest US tariffs might be working, but the reality is more complex. Most evidence points to only modest job repatriation. Many companies that left China didn’t necessarily relocate facilities to the united states—they often headed to lower-cost regions elsewhere in Asia or Latin America. The domestic impact has been mixed. Some high-value sectors did benefit from incentives, while labor-intensive industries struggled due to higher costs and a lack of skilled US workers.

The hope that tariffs would spark a wave of American manufacturing renaissance has, so far, proven more elusive than anticipated—highlighting the need for broader policy solutions, including workforce development, infrastructure investment, and strategic R&D.

Assessing the Success of Export Controls and Trade Policy

While export controls were designed to protect national security and sensitive technologies, their real-world effects have been uneven. American companies dependent on global sales faced challenges complying with shifting policy, and some foreign buyers simply turned to non-US suppliers. The cost of compliance, uncertainty, and lost business must be weighed against the intended benefits of deterring technology transfer to strategic rivals. The broader lesson of the trade war is that export controls are a blunt instrument—they shape markets for years but also have the potential for unintended consequences, like encouraging innovation outside the US sphere.

Ultimately, the metrics for success in this new era of trade war are ambiguous and evolving with the geopolitical landscape.

Is China a Threat to the US Right Now?

National Security Implications Stemming from the US China Trade War

The intersection of trade policy, technology, and security defines today's tensions. American policymakers worry that economic entanglement could expose critical sectors to foreign influence or compromise vital supply chains, especially in sensitive areas like communication infrastructure or defense equipment. Concerns about data privacy, cyber espionage, and the resilience of the national trade backbone all feed ongoing policy debates.

At the same time, heated rhetoric and active countermeasures have deepened mistrust, reinforcing a non-economic dimension to the trade war. This raises the stakes for every new policy move, with far-reaching consequences for international diplomacy, corporate investment, and the security of everyday technology used by Americans across the country.

Technology, Trade Secrets, and Geopolitical Tensions

Few areas have been as fiercely contested as the race for technological dominance. The United States accuses Chinese companies of intellectual property theft, forced tech transfers, and alignment with the chinese government to leapfrog innovation barriers. In response, sweeping export bans on microchips, 5G equipment, and AI software have created parallel universes of tech development and deployment.

At a strategic level, this isn't just about protecting trade secrets—it’s about setting the rules for how societies use and govern technology, from surveillance to social media and beyond. The implications are profound: a bifurcated world where international standards diverge, innovation splinters, and geopolitical fault lines harden around technology infrastructure as much as territory or military capability.

What is the World Trade War 2025?

Predictions: Will the Next Trade War Be More Severe?

Economists and policy analysts predict that a future global clash—dubbed "Trade War 2025"—could dwarf past disputes. Technological breakthroughs, changing alliances, digital currencies, and a growing focus on climate-linked trade policy all figure into scenarios for intensified conflict on multiple fronts. Both the United States and China are investing heavily in strategic sectors and emerging technologies, positioning themselves for another round of friction, possibly complicated by new players in regions like east asia and Africa.

The outcome? A patchwork of alliances and trade blocs, each with their own rules and priorities. If past experience is any guide, the stakes—including consumer prices, jobs, security, and innovation—are likely to rise even higher.

Export Controls, Rare Earths, and Future Global Markets

The real wildcards in a future trade war are the continued use of export controls, the availability of rare earths and critical materials, and the emergence of new global markets for services and digital goods. Strategic control of these levers will likely determine the new balance of power, as governments and corporations race to secure their foothold in the rapidly changing economic landscape.

Manufacturers and policymakers who proactively hedge supply chain risks, invest in alternative tech, and adapt to evolving regulatory environments will be best positioned to weather whatever lies ahead. Market volatility and geopolitical uncertainty, however, are likely to become the new norm.

Are the US and China Entering a Cold War?

Comparing the US China Trade War to the Original Cold War

The term “new cold war” is often invoked to describe current frictions, but there are key differences from the US-Soviet standoff of the last century. Today’s competition is economic and technological as much as military. Unlike the near-complete separation between Soviet and American blocs, the economies of the United States and China remain deeply intertwined, with bilateral trade worth over $600 billion annually. The risk, however, is that protracted hostilities could encourage further decoupling—and create an even sharper divide in global trade, tech standards, and security alliances.

Both superpowers are investing in their own spheres of influence, engaging in diplomatic outreach, and projecting new economic models to allies and emerging markets. The world will watch closely to see if ongoing disagreements can be managed, or whether polarization deepens into broader systemic rivalry.

The Role of National Security and Trade Tensions

Trade isn’t just about dollars—it's about resilience, control, and global leadership. The collision of trade and national security agendas puts decision-makers on both sides under pressure to deliver economic gains without sacrificing leverage or exposing vulnerabilities. Policies intended to protect national interests often spill over into unintended domains, from education and research to tourism and even social media usage.

"This is not simply a trade war; it’s a strategic competition between two superpowers." – Global Affairs Commentator

For businesses, investors, and ordinary consumers, the message is clear: global uncertainty is here to stay, and agility has become the ultimate competitive advantage.

Key Lessons from the US China Trade War for Manufacturers

- Diversify your supply chain

- Monitor rare earths and critical material sources

- Stay ahead of policy changes and export controls

- Embrace digital transformation and automation

FAQs on the US China Trade War

-

Why did the US China trade war start?

The trade war began as the United States sought to address a growing trade deficit with China and long-standing concerns over intellectual property theft, forced technology transfers, and unfair trade practices. The Trump administration imposed steep tariffs, hoping to force China to reform its economic policies, but the two sides quickly escalated into a broader strategic rivalry. -

How does the trade war affect rare earth prices?

Since China controls a dominant share of rare earth production, trade tensions and potential export controls have caused significant price volatility. Higher costs for these essential materials ripple through supply chains, increasing the price of high-tech goods and leading some manufacturers to seek alternative sources or invest in domestic production. -

What are the main products involved in the US China trade war?

Key products targeted by tariffs include electronics, machinery, apparel, footwear, automobiles and parts, agricultural products, and critical components for high-tech manufacturing. The broad scope of goods affected underscores the depth of integration between American and Chinese commerce. -

Is the trade war likely to escalate in the future?

Many experts believe tensions could rise again, especially as technological competition intensifies, new policy initiatives are introduced by both governments, and the global economic landscape becomes more complex. Future confrontations may focus on digital markets, critical infrastructure, and rare earths, making continued vigilance essential.

Key Takeaways from the US China Trade War

- The US China trade war altered the global economic landscape.

- Rare earths and supply chains are at the core of ongoing tensions.

- Consumers, manufacturers, and investors must adapt to new realities.

- Long-term effects of the US China trade war depend on evolving policy and international relations.

The Future of US China Trade War: My Perspective

Personal Reflection on Trade, Security, and Innovation

As someone who closely follows the intersection of economics, policy, and technology, I believe the real lesson of the us china trade war is the need for both resilience and creativity. Rigid, single-track approaches—whether pure confrontation or total engagement—are unlikely to deliver lasting security or prosperity. Both nations need new frameworks for cooperation and conflict resolution that match the complexity of today’s global economy. Innovation, in both policy and business, will be the deciding factor for who leads in the 21st century.

As consumers and as a society, our greatest advantage is adaptability: keeping an eye on geopolitical trends and arming ourselves with information, so we’re ready to navigate whatever the next wave of global competition brings.

Where Should Policy and Business Go from Here?

For policymakers: double down on alliances, invest in next-generation industries, and stay flexible in trade negotiations. For business leaders and manufacturers: diversify supply chains, invest in talent, and treat adaptability as a competitive edge. The us china trade war has shown us that the world is too interconnected for simple solutions, but also that every challenge is an invitation to find smarter, more resilient ways forward.

The final thought: The only certainty in global trade is change. Stay curious, vigilant, and collaborative, and you’ll be ready.

Stay Ahead: Subscribe for US China Trade War Updates

"Manufacturer don't miss out! Stay informed on global trade shifts—tariffs, reshoring, and supply chain updates could reshape your strategy. Subscribe to Global Trade News for Latest updates. Call 203-271-7991 today."

The ongoing US-China trade war has led to significant economic repercussions, including increased tariffs and retaliatory measures that directly affect consumers and businesses alike. For instance, China has imposed additional tariffs of up to 15% on major U.S. farm products such as chicken, pork, soy, and beef, starting from March 10, 2025. This move is in response to U.S. President Donald Trump’s order to increase tariffs on Chinese imports to 20%, escalating existing tensions from Trump’s first term. (apnews.com)

Furthermore, China has raised tariffs on U.S. goods from 84% to 125% in response to heightened U.S. tariffs, which now total 145%. This marks a significant escalation in the ongoing trade war between the world’s two largest economies. The Chinese Finance Ministry criticized the U.S. tariffs as “economic bullying” and warned of continued retaliation. (apnews.com)

These developments have heightened tensions between the world’s largest economies, stirring fears of a global economic slowdown and unsettling financial markets. The escalating trade conflict raises the risk of a global recession, and there is uncertainty over how and when the dispute might end. (reuters.com)

For a comprehensive understanding of the US-China trade war and its implications, you may refer to the detailed overview provided by Britannica Money. (britannica.com)

Add Row

Add Row  Add

Add

Write A Comment