Startling Statistic: Tariffs have rocked global trade, impacting it by a staggering 12% last year, altering traditional economic landscapes.

Unconventional Fact: Did you know that due to the current tariff policies, everyday products like bicycles and refrigerators now cost significantly more?

Understanding Who Pays Tariffs

The Role of Importers and Exporters in Tariff Payments

When considering who pays tariffs, many assume importers are the primary bearers of cost. *Importers* of goods often incorporate the tariffs into their pricing, passing the burden onto consumers. This leads to higher prices for everyday items, meaning the average person indirectly foots the bill. Additionally, the strain on domestic industries intensifies as they navigate the challenges of staying competitive against imported goods .

However, exporters are not entirely off the hook. In many cases, they lower their prices to maintain market presence despite tariffs, effectively absorbing some costs. This strategy plays a crucial role in determining a product's competitiveness in global trade . By adjusting their strategies, exporters help preserve sales volumes but may sacrifice profit margins in the process.

The Impact on Trade Policy and Economy

Trade War and Its Economic Ramifications

Engaging in a trade war often generates rippling effects on both domestic and international markets. Such conflicts lead to increased pricing pressure on goods and disrupt supply chains, affecting everything from raw materials to finished products. Domestic markets witness higher tariffs leading to loss of manufacturing jobs , as cost hikes make local goods less appealing on the global stage.

Countries embroiled in such battles typically deploy a variety of economic strategies to counteract the negative outcomes. Some opt to negotiate trade deals or adjust tariff rates to mitigate revenue loss and maintain a balanced trade deficit . For insights into how trade policies are evolving, you can explore the Economic Report of the President 2025 . Nonetheless, the impact is profound and often requires coordinated actions by national governments and traders alike.

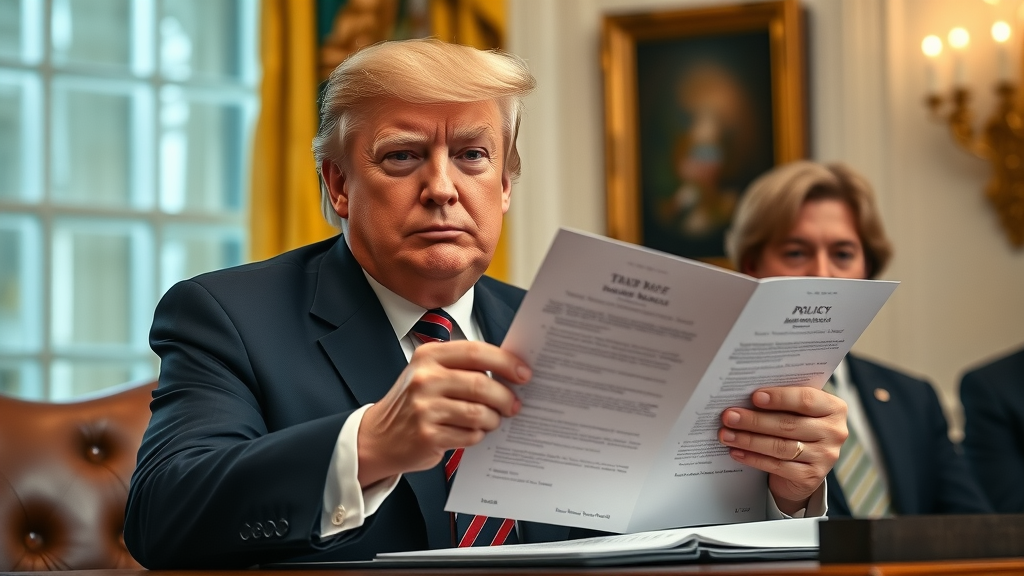

The President's Influence: President Trump and Trade Policy

How the Trump Administration Shaped Tariff Policies

The Trump administration heavily influenced the United States' approach to tariffs. Under President Donald Trump , the focus centered on reducing the national trade deficit , asserting tariffs as a means of protecting domestic industries . Tariff applications touched crucial sectors like steel and aluminum and extended across various sectors worldwide.

Assessments of these policy shifts present a mixed bag of results. Advocates applaud efforts toward bolstering U.S. manufacturing and jobs, whereas critics highlight adverse repercussions like strained relations with trading partners . The deliberate imposition of tariffs led to a rollercoaster of economic responses, reflecting on both the successes and setbacks of Trump's trade agenda. For a deeper understanding of the current trade policy landscape, consider reading about Jamieson Greer’s Trade Policy Agenda .

The White House's Current Stance on Tariffs

Today, the current administration remains embroiled in the debate over tariffs and their influence on national and international scales. By balancing trade policies , the leadership aspires to stabilize the nation's economic footing while securing beneficial agreements with key global partners . Looking ahead, understanding these strategies offers insight into potential shifts on the horizon for trade regulations.

Comparative Table of Tariff Effects: United States vs Global |

||

Aspect |

United States |

Global Impact |

|---|---|---|

Trade Deficit |

Moderately Reduced |

Varied |

Product Prices |

Increased |

Variable |

Market Competitiveness |

Challenged |

Adapted |

Global Reactions and Adaptations

Countries' Responses to the US Tariff Policies

Various countries have reacted differently to U.S. tariff policies , designing unique strategies to counteract trade barriers. While some have engaged in new trade agreements or formed blocs to bolster their positions, others actively reassess their roles within regional trade arrangements . These reactions illustrate the adaptive nature of nations worldwide in mitigating tariffs' effects.

Impact on Trade Deficit and Economic Relations

The initiation of tariffs often redefines trade dynamics, influencing economic alliances and the international trade deficit . Countries experiencing altered trade balances must adapt swiftly to remain competitive and sustain economic relationships. One expert opines, "Tariffs, though effective in some sectors, often inadvertently strain vital economic ties."

Exploring the Long-term Impacts on Future Trade

Predicting Future Trade Policy Changes

As we navigate the unpredictable terrain of international commerce, future shifts in trade policy will play a decisive role. Drawing from historical precedents and present trends, stakeholders and analysts anticipate policy evolutions that embrace technology and global interactions. One trade adviser predicts, "The future of tariffs hinges on harmonizing regulations that prioritize efficient global collaboration."

People Also Ask: Contextual Questions About Tariffs

Who pays for trade tariffs?

Typically, buyers within the importing country bear the cost of tariffs, reflected in higher consumer prices, altering market dynamics and purchasing power.

Does the buyer or seller pay tariffs?

Primarily, the buyer incurs the tariff cost. However, sellers might indirectly absorb effects through enhanced competitive pricing strategies to remain viable.

Do exporters pay the tariff?

While exporters are not directly responsible, they may adjust pricing to compensate for reduced demand, balances influenced by international economic conditions.

Who are tariffs paid to?

Tariffs serve as customs duties enacting payments to government bodies during the import process, with funds contributing to national economic systems and policies.

Tariffs frequently influence industries like technology, agriculture, and manufacturing, with impacts that ripple through related sectors. In the words of a former trade adviser, "Understanding tariff efficiency demands a keen examination of their direct and peripheral outcomes."

Delving into who pays tariffs unravels crucial economic points: the immediate financial burden, prolonged consumer effects, and expansive international ramifications. These insights encourage ongoing discourse regarding tariffs and their entrenched role in shaping global trade .

Concluding Thoughts: Reflecting on Tariffs' Broader Implications

Current tariff implementations underscore complex, far-reaching impacts on global economies. As policies evolve, critical examination remains key to understanding potential outcomes and international commerce's broader future.

Add Row

Add Row  Add

Add

Write A Comment