Revolutionizing Metal Buying: Why Online Metal Ordering Matters More Than Ever

The world of metal purchasing has changed dramatically. Gone are the days when securing high-grade aluminum, stainless steel, or other metals meant endless phone calls, complicated quotes, or picking through limited stocks at local supply yards. Now, the demand for convenience, product variety, and reliable fulfillment has driven a new age of online metal ordering—where a few clicks can bring countless materials to your fingertips. For DIY enthusiasts, small manufacturers, and even large industrial buyers, this shift opens the door to a more efficient and transparent way to source metals for all kinds of projects.

But as much as convenience is celebrated, the move to online metal ordering introduces new questions and sometimes frustration. Can buyers trust the quality matches what’s promised? How quickly can orders be fulfilled? And what happens if the material isn’t exactly right? These concerns aren’t minor—choosing the wrong piece of steel or aluminum can ruin an entire project or lead to significant delays. Understanding the landscape of online metal ordering is now essential for anyone who values quality, speed, and peace of mind in metal sourcing. Let’s explore why mastering online metal ordering is essential and what you need to know to navigate it effectively.

What Is Online Metal Ordering? The Modern Marketplace for Aluminum, Steel, and More

Online metal ordering refers to the process of purchasing metals—such as aluminum, steel, and copper—through digital platforms that streamline the traditional supply chain. Instead of visiting physical warehouses, buyers can now browse vast catalogues of materials, compare grades and sizes, and place orders for delivery or pickup from the comfort of their device. This approach integrates key features like instant stock checks, shipping calculations, and rapid fulfillment, transforming what was once a fragmented process into one marked by choice and flexibility.

The rise of online metal ordering platforms brings a host of new advantages. For starters, anyone can access metals in precisely the size, grade, and finish they need—eliminating the guesswork. Whether it’s aluminum plates for a machinery build, stainless steel for kitchen upgrades, or sheet metal for art projects, buyers no longer face minimum order roadblocks or hard-to-find materials. However, for those unfamiliar with this approach, the learning curve can seem steep. Making mistakes in material specification, missing out on available options, or trusting the wrong supplier can result in extra costs and delays. Informed navigation of online metal ordering is crucial, and understanding its structure can mean the difference between project success and frustration.

Why Online Metal Ordering Simplifies Every Step of Steel Purchasing

Industry experts recognize that online metal ordering transforms the entire buying journey, and this new way of sourcing materials comes with clear twists on old challenges. Rather than waiting on quotes or sorting through limited stocks, users have access to a broad, continuously updated inventory right at their fingertips. Through Online Metals, for instance, customers can simply choose the grade and size they need, enter pickup locations, and receive immediate eligibility confirmation for online order pickup. This end-to-end approach means less guesswork and more control, with the added benefit of speed—orders are often ready for pickup or shipped in as little as one to two days.

The outcomes are tangible. Online metal ordering doesn’t just make buying faster—it creates an unprecedented level of transparency, choice, and reliability. Customers across all backgrounds, from home-project tinkerers to full-scale manufacturers, find that picking the exact steel, aluminum, or bronze they need is no longer a gamble. Clear instructions and accessible support, such as prominent signage at warehouses or phone help for accessibility needs, foster a sense of confidence. The result is a system where getting the right steel is as straightforward as shopping for any everyday product online—no matter the project’s scale or complexity.

From Warehouse Hunts to Online Convenience: The Evolution of Metal Supply

Historically, sourcing metals required physical visits to supply yards, phone negotiations, and often settling for what's available over what's ideal. This method not only restricted choice but also increased the possibility of material mismatches and extended lead times. The digital revolution, spearheaded by online metal ordering, has fundamentally changed this legacy model. Now, customers can source brass, titanium, and even niche alloys without stepping away from their workspace. This means projects move forward without unnecessary downtime, and buyers are equipped to make informed decisions instantly.

Moreover, today's digital platforms provide clear product categories—aluminum plate, stainless steel sheets, copper rounds, and more—making comparison and decision-making faster and more transparent. The clear advantage is speed and flexibility: metal buyers can access their materials within hours rather than days or weeks. Also, the shift to digital has democratized access, enabling small-batch DIYers and professionals alike to participate in the marketplace with the same level of service and choice large industrial firms have traditionally enjoyed.

How to Maximize Your Success with Online Metal Ordering

Navigating online metal ordering involves more than just selecting an item and clicking ‘buy.’ It’s a process that rewards preparation and attention to detail. Carefully reviewing material grades, understanding the unique sizing offered, and familiarizing yourself with pickup or shipping eligibility ensures there are no costly surprises. Many online platforms—like those used by major suppliers—feature quick quotes, live chat support, and transparent order modification options that can save time and prevent errors.

The process is designed to be intuitive: from scanning product categories, entering specific requirements, to tracking the status of your order. For buyers who need materials fast, features like in-house pickup windows and prompt order readiness notifications are indispensable. It's also wise to note any special considerations, such as accessibility support or unique holiday hours, that may affect pickup or delivery timing. By leveraging all these resources, buyers gain the double benefit of a stress-free experience and the assurance that their materials will meet the demanded specifications every time.

The Unseen Value of Informed Digital Metal Purchasing

Embracing online metal ordering isn’t just about convenience; it’s about gaining a strategic edge. Engaged buyers who understand online ordering systems often unlock savings through larger-volume discounts or promotional deals displayed directly on supplier websites. The ability to track order history, quickly modify orders, and access customer support helps buyers avoid the hidden costs of misorders or missed deadlines. Platforms with robust infrastructure ensure secure transactions and accurate fulfillment, so even sensitive or high-stakes orders are handled with care.

Ultimately, the move to digital means more than just speed—it represents a cultural shift in the metals industry. Buyers now expect seamless service, accurate fulfillment, and a breadth of options tailored to unique project needs. As online ordering platforms continue to evolve, those who invest in understanding and using these tools find themselves ahead, able to deliver more value to their clients, teams, or personal projects.

Online Metals’ Expert Approach: Efficiency, Access, and Assurance in Metal Supply

Online Metals embodies a philosophy centered on access, reliability, and practical support throughout the online metal ordering journey. Their approach combines an expansive warehouse inventory with a user-driven online platform, making every aspect of shopping—from price checking to pickup—far more transparent and flexible. Clear warehouse signage and helpful staff ensure that even in-person pickups adhere to a streamlined experience. For those with accessibility requirements, the option to request phone assistance demonstrates a commitment to supporting every customer’s needs.

The business model at Online Metals is built on the expectation of speed without compromise. By offering features like online quick quotes, live chat, and in-house pickup, the company removes traditional barriers to sourcing metals. Their structure accommodates both large and small order volumes, with clear communication around eligibility and prompt readiness notifications. With a dedication to responsive assistance and fast fulfillment, Online Metals helps ensure that customers never have to wonder if their project will be held up by unavailable materials or complex processes.

At every stage, Online Metals positions itself as a leader in education and clarity for buyers. Their focus on accessible product categorization and supportive order modification flows reflects a deeper mission: empowering every customer, regardless of project size or experience, to have the confidence to order metals online and get to work faster with exactly what’s required.

Real Success Stories: How Online Metal Ordering Delivers Every Time

Feedback from customers shines a light on the direct benefits of online metal ordering. The experience is not just about convenience, but about reliable outcomes and support that stands out even in a world of digital transactions. For many, the process brings peace of mind and often exceeds expectations in customer service, speed, and product quality.

I’ve been using online metals for the last couple years as a supplier for personal home projects. The quality of metal is great and I’ve experienced the best customer service of anywhere! Very responsive company and so helpful! Shipping is very fast and I usually have my items within two days. Can’t be beat!

—Christopher S.

First-hand accounts like this confirm the practical value of online metal ordering for all types of buyers. When reliability, material quality, and support are all delivered as promised, the risk and worry typically associated with metal sourcing fade away. For those looking to start their next project with confidence, the story above reinforces that using expert-driven online platforms can be the smartest step forward.

Online Metal Ordering: A Gateway to Smarter, Faster, and Smoother Projects

In today’s fast-paced project environment, the ability to order metals online is not just a convenience—it’s a tool that can set apart efficient planners from those stuck in outdated purchasing cycles. The streamlined process, broad product access, and expert support make online metal ordering the logical choice for anyone seeking to save time and avoid mistakes. As seen through the user-first model exemplified by leaders in the space, this approach delivers outcomes that build project momentum and ease worry. For everyone from home project enthusiasts to seasoned manufacturers, online metal ordering is now a cornerstone of modern, reliable materials sourcing.

For those committed to accuracy, speed, and top-tier results, leveraging online metal ordering platforms means more than simple buying—it can be the difference between delays and satisfaction on every project. Expert-driven approaches and robust online tools ensure that whether the need is steel, aluminum, or more specialized alloys, materials sourcing is now faster, easier, and more certain than ever.

Contact the Experts at Online Metals

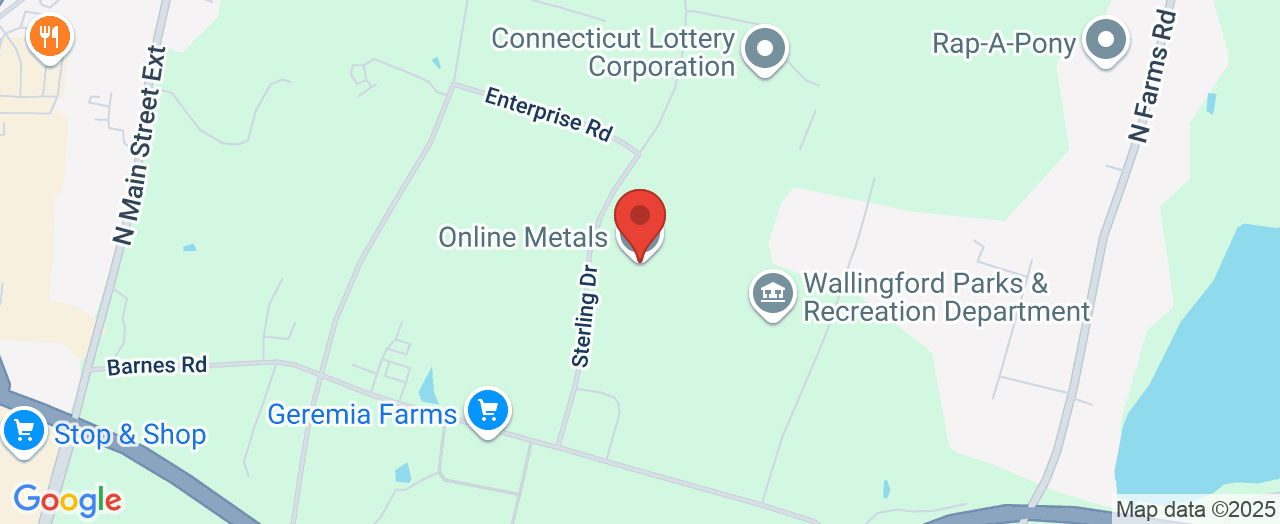

If you’d like to learn more about how online metal ordering could benefit your sourcing needs, contact the team at Online Metals. 📍 Address: 5 Sterling Dr, Wallingford, CT 06492 📞 Phone: +1 888-527-3331 🌐 Website: https://www.onlinemetals.com/en/location-and-hours/wallingford

Online Metals – Wallingford, CT Location and Hours

🕒 Hours of Operation:📅 Monday: 7:00 AM – 7:00 PM📅 Tuesday: 7:00 AM – 7:00 PM📅 Wednesday: 7:00 AM – 7:00 PM📅 Thursday: 7:00 AM – 7:00 PM📅 Friday: 7:00 AM – 3:30 PM📅 Saturday: ❌ Closed📅 Sunday: 9:00 AM – 2:00 PM

Add Row

Add Row  Add

Add

Write A Comment