Did you know U.S. businesses handed over a staggering $85 billion in tariffs during 2022—an expense that manufacturers and consumers ultimately paid? While policy makers tout trade tariffs as economic shields, the reality for many is shrinking profit margins and rising costs. If you’re a manufacturer, ignoring the actual impact of trade tariffs could mean losing out in a rapidly shifting global market. This in-depth guide will help you separate the facts from the myths and show you how to protect your bottom line.

Opening Insights: The Surprising Realities of Trade Tariffs "In 2022, U.S. businesses paid over $85 billion in tariffs—costs largely passed directly to manufacturers and consumers alike." Trade tariffs are often described as tools to boost domestic industry and create fair conditions in international trade. But for U.S. manufacturers, the realities can be alarmingly different. Tariff rates aren’t just abstract numbers; they directly shape the global supply chain, affect profit margins, and alter competitive positioning overnight. Businesses, primarily in the United States and European Union, are navigating a world where tariff schedules shift with every new trade war or executive order. In practice, this often means expensive imported components, unpredictable costs, and tough decisions on where to source materials. While trade barriers may shield some sectors, they frequently trigger retaliatory tariffs from trading partners, escalating trade costs for everyone. Recent high-profile tariff battles—like those on steel and aluminum—reveal that efforts to help U.S. manufacturing sometimes lead to complicated consequences. Are these policies really delivering better jobs and stability, or are they simply hiking prices across supply chains? This article walks you through the evidence, so you can make informed decisions in this era of global trade uncertainty. What You'll Learn About Trade Tariffs and Manufacturing Impact What trade tariffs are and how they work

How trade tariffs set by the United States and European Union affect manufacturers

Key trade war moments and their consequences

Understanding tariff rates, tariff revenue, and tariff schedules

The role of reciprocal tariff agreements and retaliatory tariffs

Opinion: Why trade tariffs may be hurting rather than helping domestic industries Trade Tariffs Explained: Foundations and Key Terms

Defining Trade Tariffs: What Are They? A trade tariff is a government-imposed tax on goods imported from another country. Tariffs raise the price of imported products, making them less competitive against domestic goods. In political rhetoric, they’re often framed as defenders of national industry and jobs. But beneath the surface, tariffs are a form of trade barrier that can disrupt established supply chains and inflate input prices. Understanding tariffs means knowing their types. Specific tariffs are set fees per unit (like $50 per ton of steel), while ad valorem tariffs are based on a percentage of the product’s value (for example, a 10% tariff on electronics). The rules for which products are taxed, and at what rate, are specified in documents known as harmonized tariff schedules. These schedules vary across countries and are at the heart of every trade deal and dispute. Whether it’s the United States or European Union, every economy negotiates, imposes, and adjusts its tariff rates to protect certain industries or as leverage in a trade war. For a deeper dive into the real-world financial consequences of tariffs, including often-overlooked expenses that impact manufacturers and importers, you may want to explore how international trade tariffs create hidden costs across global supply chains. Understanding these nuances can help businesses anticipate challenges and make more informed decisions. Understanding Tariff Rates and Harmonized Tariff Schedules Tariff rates are set by each country based on industry priorities, economic strategy, and often, political motives. The harmonized tariff schedule is a standardized system that classifies traded goods and assigns codes to determine the tariff rate applied. This international system ensures goods are categorized consistently, from shoes to microchips. For businesses, reading and interpreting the tariff schedule is essential. It determines landed costs, influences pricing strategies, and can have a direct effect on profit margins. For example, a sudden government announcement—like one from the White House or the European Union—can shift hundreds of line items virtually overnight, as seen in major trade disputes over steel and aluminum or electronics. Understanding harmonized codes, baseline tariffs, and scheduled changes helps companies anticipate and respond to potential cost increases or competitive disadvantages. Role of the United States and European Union in Global Trade Tariffs The United States and the European Union together account for a significant share of world trade and set many global norms in tariff policy. They impose tariffs to counteract perceived unfair trade practices, protect strategic industries, or retaliate against partners in a trade war. Their actions can set global precedents, especially when they issue executive orders, update tariff schedules, or sign new trade agreements. Often, when the U.S. implements or raises tariffs, partner countries like the European Union respond with their own reciprocal tariffs, impacting a wide range of products from agriculture to heavy machinery. This constant back-and-forth can destabilize global markets, force businesses to review their supply chains, and lead to higher costs for downstream manufacturers. With every new trade policy pivot, industries worldwide must adapt rapidly or risk falling behind. People Also Ask: Key Questions on Trade Tariffs

What is a trade tariff? A trade tariff is a tax imposed by a government on imported goods, designed to make foreign products more expensive than domestic ones. This helps protect local industries from overseas competition but can raise prices for consumers. Tariffs can be specific (set amounts) or ad valorem (percentage of value), and they appear as extra charges on shipments entering a country. The intent is often to balance trade, support economic policy, and sometimes to serve as a political tool during trade wars. Are tariffs good or bad for the economy? The impact of tariffs on the economy is complex and debated by experts. Proponents claim they protect domestic industries, secure jobs, and balance the trade deficit. However, critics highlight that tariffs tend to increase the cost of goods, disrupt free trade, and can spark retaliatory tariffs from other countries. These ripple effects can hurt manufacturers reliant on global supply chains and raise prices for end consumers. Most trade policy shifts have mixed results, and their effectiveness depends on global context, enforcement, and strategies adopted in response. What is this Trump tariff? During his presidency, Donald Trump initiated a series of tariffs targeting imports from countries like China, Canada, and the European Union. Known as “Trump tariffs,” these measures sought to reduce the trade deficit and protect U.S. industries such as steel, aluminum, and manufacturing. The White House issued tariffs as high as 25% on steel and 10% on aluminum, prompting trading partners to respond with their own retaliatory tariffs. This ushered in a significant trade war era, altering supply chains and profit margins for countless U.S. manufacturers. What is an example of a tariff? A classic example is the 25% tariff the United States applied on imported steel during the Trump administration. This policy was meant to boost domestic production by making foreign steel more expensive. Other examples include tariffs on Chinese electronics, Canadian lumber, or EU cheese. Each instance has immediate effects on importers, exporters, and the industries dependent on these goods, influencing everything from manufacturer costs to consumer prices. Historical Context: Trade Tariffs, Trade Wars, and Their Manufacturers' Impact

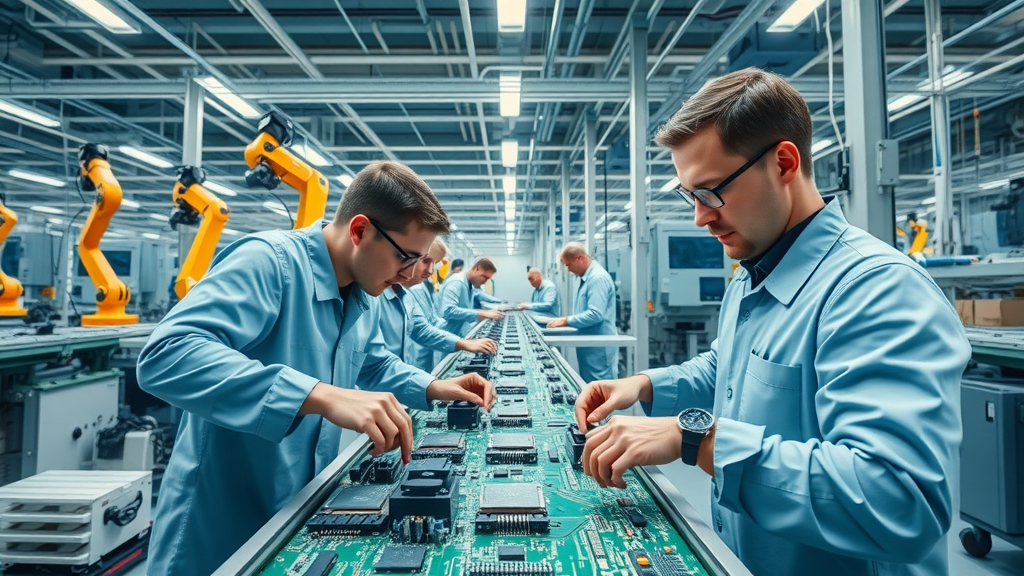

U.S. Trade Tariff Policy Shifts: President Trump and Beyond The arrival of the Trump administration marked a turning point in the U.S. trade policy playbook. Using tariffs as leverage, the White House shifted from supporting multi-lateral free trade agreements to a more adversarial approach. The administration imposed tariffs targeting countries accused of unfair trade, notably through steel and aluminum tariffs, shaking up the post-World War II commitment to global free trade. Since then, the debate over imposed tariffs and their broader effects has dominated economic policy circles. These policy changes were not limited to one administration. Trade tariffs and the threat of retaliatory tariffs continue to loom large, with each new executive order prompting adjustments in global supply chains. Although meant to reduce the U.S. trade deficit and address perceived abuses, the actual outcome for manufacturers has often been much more complicated, involving higher input costs and market disruption. Major Trade Wars: Steel and Aluminum as Case Studies One of the defining episodes of recent years is the trade war over steel and aluminum. In 2018, new U.S. tariffs raised global steel prices and reverberated throughout industries from construction to automotive manufacturing. While some U.S. producers cheered the move, many downstream manufacturers faced sharp cost increases for vital materials. The European Union and other partners retaliated quickly, imposing tariffs on a list of American goods—everything from motorcycles to agricultural products. For manufacturers, this round of economic brinkmanship resulted in higher costs, lost contracts, and a scramble to readjust supplier networks. These case studies illustrate how tariff rates and imposed tariffs can kick off wider trade conflicts with lasting impacts on entire industries. European Union’s Reciprocal Tariff Response The European Union has consistently used reciprocal tariffs to counter U.S. trade barriers. Whenever the U.S. introduces a new tariff rate or targets a sector, the EU council gathers to impose similar restrictions on American exports. This tit-for-tat strategy aims to discourage further escalation, but it often results in both regions facing higher consumer prices and business uncertainty. These responses are carefully calibrated within the framework of existing trade agreements and World Trade Organization rules. Over the past decade, the U.S.–EU trade relationship has been shaped by these retaliatory measures, affecting everything from wine and cheese to motor vehicles and heavy machinery. For manufacturers caught in the crossfire, the uncertainty and cost volatility have become an ongoing challenge, making long-term strategic planning increasingly difficult. The Numbers: Tariff Rates, Tariff Revenue, and Tariff Schedules

How Tariff Rates Are Determined Tariff rates are determined by each country’s trade authorities, usually in negotiation with international partners. For the United States, the U.S. International Trade Commission and the White House play roles in setting baseline tariffs, adjusting rates based on current economic priorities, and responding to alleged market abuses. Often, these rates are influenced by lobbying from domestic industries, foreign policy objectives, or efforts to correct a trade deficit. When a new round of tariffs is proposed—a process that can involve public comment periods and economic impact studies—a final tariff schedule is published listing the products, codes, and applicable percentage or fixed rate. These scheduled rates can be found in public government databases, enabling businesses worldwide to calculate their expected import costs and make informed sourcing decisions. Tariff Revenue: Who Pays the Bill? While tariffs are paid at the border by importing companies, the cost almost always gets passed down the line. Ultimately, manufacturers, distributors, and consumers bear the brunt of these taxes. The U.S. government, in 2022 alone, collected over $85 billion in tariff revenue, funds that went straight to the treasury but added up to substantial expenses in goods production and distribution. For small to mid-sized manufacturers, these costs can exhaust already thin profit margins. It’s a critical reason why many industry groups and economic analysts argue that tariffs, while politically popular, can function as hidden taxes undermining the very producers they’re meant to help. Historical reactions to climbing tariff revenues include adjustments to product offerings, layoffs, or even moving operations abroad. Deciphering the Harmonized Tariff Schedule The harmonized tariff schedule (HTS) is the backbone of international trade. Each traded item is assigned a code based on its nature, composition, and end use. For example, the code for raw steel differs from that for finished auto parts, and each comes with its own tariff rate. This system, standardized globally but with local adaptations, gives customs officials and importers a shared language for assessing trade duties. Deciphering the HTS is vital for compliance and cost planning. Mistakes in coding can lead to severe penalties or unanticipated cost hikes. That’s why most larger manufacturers employ compliance specialists or partner with logistics providers fluent in the latest harmonized updates. For small producers, getting caught out by a surprise tariff can erase months of anticipated profits and damage relationships with overseas customers. Table: Comparative Tariff Rates—U.S. vs. European Union vs. Global Averages Region/Country

Average Tariff Rate

Notable Product Tariffs United States

1.6% (average MFN tariff rate)

Steel: 25%; Aluminum: 10%; Electronics: 2-5% European Union

1.7% (average MFN tariff rate)

Agriculture: up to 20%; Autos: 10%; Steel: Variable Global Average

5.0%

Highly variable (agriculture, textiles often highest) Trade Deals, Agreements & Retaliatory Tariffs

The Intricacies of Modern Trade Agreements Modern trade agreements aim to create fair conditions and reduce uncertainties for businesses in a world of shifting borders and policies. These deals establish baseline tariff rates, regulate non-tariff barriers, and detail procedures for dispute resolution. They can take the form of multi-lateral treaties, like the World Trade Organization agreements, or bilateral deals involving only two countries. Examples include the U.S.–Mexico–Canada Agreement (USMCA) and the European Union’s various trade deals with Asia and Africa. These agreements lay out the fine print for tariff schedules, creating more stability and predictability. They also often include “safeguard clauses” that permit sudden tariff increases in emergencies, highlighting the delicate balance between free trade ambitions and the desire to protect domestic interests. Retaliatory Tariffs: Striking Back in the Trade War When one country imposes tariffs, affected trading partners often react swiftly with retaliatory tariffs. In recent years, the cycle of imposed tariffs and retaliation has defined U.S. and E.U. relations with trading giants like China. The logic is simple: to discourage unilateral action and maintain leverage in ongoing or future trade deals. The results, however, can be unpredictable. Retaliatory moves can result in entire supply chains being upended, with key industries suddenly facing diminished exports or sharply increased costs. This cycle can also foster a “tariff domino effect,” as countries not initially involved swing into action to protect their own interests. For businesses, retaliatory tariffs mean they must remain agile, building contingency plans against policy shocks from anywhere in the value chain. Are Reciprocal Tariffs Fair? Examining the Arguments One of the most heated debates in international trade policy is whether reciprocal tariffs actually deliver fairness. Supporters argue they ensure a level playing field—if foreign governments tax your goods, you respond in kind. Critics counter that reciprocal measures tend to spiral, damaging all sides and inflating costs for everyone from factory workers to end consumers. In practice, reciprocal tariff strategies rarely wind down trade wars. More commonly, they prolong disputes, making global supply chains more fragile. The result is further pressure on manufacturers to shift sourcing, reconsider investment decisions, or even lay off workers due to falling overseas sales. To resolve these cycles, experts recommend doubling down on trade agreements and dispute resolution mechanisms, though progress is often slow and politically sensitive. Opinion: Why Trade Tariffs May Be Failing U.S. Manufacturers "Tariffs meant to protect American manufacturing often miss the mark, driving up raw material costs more than they help domestic producers." Analyzing Trade Deficits and the Real Cost to Manufacturers The intention behind rising tariffs is often to reduce the trade deficit and revive struggling industries. Yet the results so far suggest manufacturers often incur more pain than gain. When tariffs are imposed, imported component prices climb, especially for goods not readily produced in the U.S. For many mid-sized manufacturers, these cost hikes quickly eat away at slim margins—without meaningful new sales or jobs to offset the pain. Additionally, retaliation from trading partners frequently hurts export markets. American products become more expensive and less competitive abroad, eroding hard-won global market share. Ultimately, the net result is a manufacturing sector squeezed from both sides—higher input costs at home and shrinking demand overseas—a losing scenario for the very workers the policies are supposed to support. Case Study: Steel and Aluminum Tariffs’ Effects "As a mid-sized U.S. manufacturer, we saw profit margins drop 11% after recent tariff hikes—far outweighing any competitive gains." The 2018 tariffs on steel and aluminum provide a clear illustration. While American steelmakers initially benefited from less foreign competition, hundreds of downstream manufacturers—from auto parts to construction supplies—reported skyrocketing input prices. The result was twofold: higher prices for American-made goods and, in some cases, lost business as foreign purchasers turned elsewhere. For the automotive sector, the impact was immediate. Car manufacturers, facing hundreds of millions in extra costs, were forced to raise prices or cut corners. Many small to medium-sized manufacturers, whose products hinge on low margins and global competitiveness, struggled most. In the end, these cascading effects show why even well-intentioned tariff policies often backfire, costing more jobs than they create. Lists: Winners and Losers in a Trade Tariff World Industries benefiting from tariffs: select agricultural sectors, protected domestic industries.

Industries harmed by tariffs: auto manufacturers, tech manufacturers, exporters facing retaliatory tariffs, downstream supply chains. Frequently Asked Questions (FAQs) on Trade Tariffs How do I find a product’s tariff rate? Check the U.S. International Trade Commission or your country’s customs authority. Use the product’s harmonized tariff code to look up the latest tariff rates and schedules online.

What is a harmonized tariff code? It’s an internationally standardized system of numbers used to classify traded products. This code determines the tariff rate charged at the border and ensures consistency worldwide.

How do countries negotiate trade tariff agreements? Through diplomatic negotiations, usually involving trade ministries, with the aim of reducing barriers and creating fair, predictable trading conditions. These negotiations culminate in treaties specifying tariff schedules and mutual obligations.

What are the long-term impacts of trade wars? Extended trade wars can shift supply chains, increase business uncertainty, raise consumer prices, and reduce economic growth. While some industries may be shielded, most experience higher costs and volatility. Key Takeaways: Navigating Trade Tariffs as a Manufacturer Know your supply chain’s exposure to tariff risks.

Regularly review official tariff schedules and trade agreements.

Engage with policy experts on impending trade policy changes.

Leverage trade agreement advantages where possible. Conclusion: Charting the Future—Adapting to Global Trade Tariffs Stay informed, adapt your strategies, and engage in the public conversation: the future of trade tariffs is in flux, and proactive manufacturers will be best positioned for success. If you’re looking to expand your understanding of the broader forces shaping today’s global trade environment, it’s worth exploring the underlying dynamics of trade wars and their far-reaching effects. By delving into what truly drives a trade war and how these conflicts reshape international commerce, you’ll gain valuable context for navigating future policy shifts. This perspective can empower you to anticipate market changes, identify new opportunities, and develop more resilient strategies for your business. Take the next step and equip yourself with the knowledge to stay ahead in an ever-evolving global marketplace. Voice Your Opinion—The Trade Tariff Debate Needs You "The debate on trade tariffs is far from settled, and the input of real manufacturers can drive smarter, better policies for all." Call to Action: Make Your Opinion Matter on Global Trade Notes Got Something to Say About Global Trade? RP Design Web Services can put your insights on Global Trade Notes in front of the right audience. Call 203-271-7991 today and get your word out. Trade tariffs are government-imposed taxes on imported goods, designed to make foreign products more expensive and less competitive compared to domestic ones. While they aim to protect local industries and generate revenue, tariffs often lead to higher costs for consumers and can disrupt global supply chains.

In recent years, the United States has implemented various tariffs under the Trump administration, significantly impacting international trade dynamics. For instance, in 2025, the U.S. imposed a 10% baseline tariff on all imports, with higher rates for specific countries and products. This move led to retaliatory measures from trading partners, including Canada and Mexico, resulting in a complex trade environment. (en.wikipedia.org)

The economic consequences of these tariffs have been substantial. Germany’s economy contracted by 0.3% in the second quarter of 2025, largely due to weakened demand from the U.S. following the implementation of tariffs. This downturn highlights the far-reaching effects of trade policies on global economies. (reuters.com)

For manufacturers, understanding the intricacies of trade tariffs is crucial. Tariffs can lead to increased production costs, supply chain disruptions, and reduced competitiveness in international markets. Staying informed about current trade policies and their potential impacts can help businesses navigate these challenges effectively.

In summary, while trade tariffs are tools used by governments to protect domestic industries and address trade imbalances, they often come with unintended consequences that can affect manufacturers and consumers alike. Being aware of these dynamics is essential for businesses operating in the global market.

Add Row

Add Row  Add

Add

Write A Comment