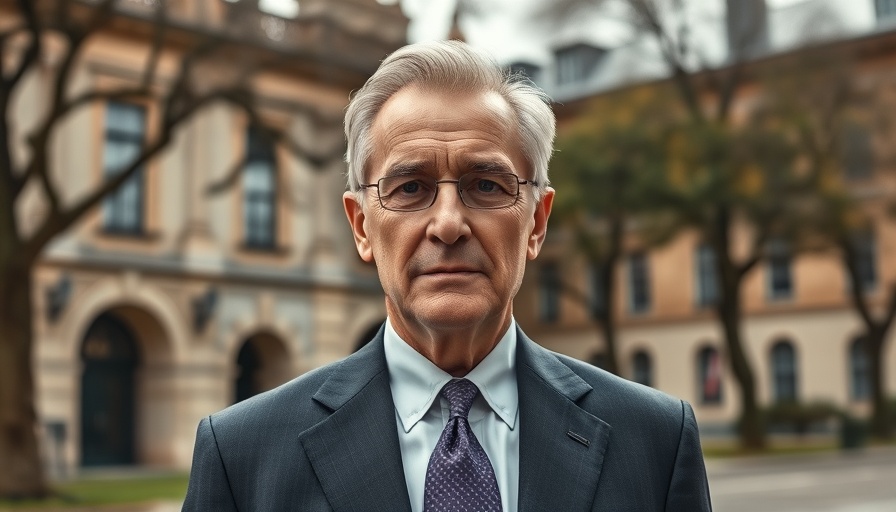

What Treasury Secretary Scott Bessent is Saying

Treasury Secretary Scott Bessent recently made headlines with his assurances on the current financial landscape during an interview on NBC's Meet the Press. Emphasizing the Trump administration's proactive measures to avert a potential financial crisis, he stated, "What I could guarantee is we would have had a financial crisis" had government spending not been reined in. Bessent's insights come amidst a turbulent market phase characterized by recent declines and fears over inflation due to ongoing tariff disputes.

Market Volatility: A Common Phenomenon

Despite the current market corrections, Bessent advocates for a longer-term outlook, describing these pullbacks as normal. Drawing from 35 years in the investment sector, he argues that corrections are essential for a healthy market, suggesting that it’s the euphoric, unchecked rallies that lead to significant crises. This perspective aligns with historical patterns where preventing inflation through market adjustments can avert more severe downturns.

Understanding the Bigger Picture: Economic Growth and Challenges

While reassurances about avoiding a financial crisis are welcomed, Bessent's acknowledgment that "there are no guarantees" concerning a recession adds a layer of complexity to the current economic narrative. His views echo sentiments from various economists who suggest that significant government spending needs to be countered by robust fiscal policies. In terms of the U.S. economy’s future, it’s crucial that sustainable economic practices are prioritized to predict and mitigate recession risks.

A Glimpse into Policy Changes

As President Trump emphasizes fiscal responsibility within his administration, notable actions include the establishment of the Department of Government Efficiency, aimed at streamlining costs and enhancing productivity across government agencies. The initiative, led by tech mogul Elon Musk, represents a mix of private-sector efficiency paired with governmental oversight—a blend that could set a precedent for future economic strategies.

The Impact of Policy on Global Finance

These U.S. economic strategies do not exist in a vacuum; they ripple into global finance. As American markets are influenced by tariffs and trade relationships, Bessent's pro-business policies are expected to fortify not just domestic, but international financial stability. The interplay of U.S. policy with global market dynamics emphasizes the interconnected nature of modern economies, where actions taken in one region can have widespread implications.

What Lies Ahead: Insights and Predictions

Looking ahead, Bessent's optimism may be refined through the lens of ongoing economic challenges. With the S&P 500's recent correction marking a volatile start to the current fiscal year, investors and policymakers alike will need to remain vigilant. As Bessent succinctly put it, effective tax policies and energy security are paramount for fostering market stability in the long haul.

This narrative highlights the undeniable complexities of managing a robust economy in times of uncertainty. Understanding these fundamentals can empower readers navigating their financial futures amidst potential volatility.

In summary, while the current financial landscape bears uncertainty, proactive measures combined with informed fiscal policies could lead to greater stability and growth, both domestically and globally.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment