Did you know that over $420 billion in global trade is directly affected by tariffs every year? This staggering figure isn’t only about government policy or political headlines—it’s about the price of your morning coffee, the smartphone in your pocket, and the job market in your city. Global tariff trends are no longer just a distant debate for trade lawyers or diplomats; they now shape the very fabric of our economic future and impact the lives of everyone, from everyday consumers to business owners. In this article, you’ll learn exactly how tariffs drive changes in your world, why these shifts matter, and what to watch for as global trade continues its rapid transformation.

What You’ll Learn

- How global tariff trends directly impact consumer prices and daily economics

- The effects of tariff rate changes on the United States and the international landscape

- The complexities of reciprocal tariff policies and their effect on world trade

- Why trade wars escalate and how they ripple through the global economy

- The intricate relationship between tariffs, supply chains, and national trade agreements

- Actionable steps for consumers and businesses to adapt to evolving tariff environments

The Impact of Global Tariff Trends: Why Every Consumer Should Care

Most discussions about global tariff trends focus on government negotiations or economic theory, but their effects are much more personal and widespread than many realize. Every day, tariffs imposed on imported goods—from steel and aluminum to electronics and groceries—alter the prices consumers see at the register. Product costs rise, supply chains reroute, and companies respond by changing their operations or passing costs on to shoppers. In the United States and worldwide, these shifts can mean higher prices at the grocery store, changes in what’s available on store shelves, and even job losses or gains in key industries.

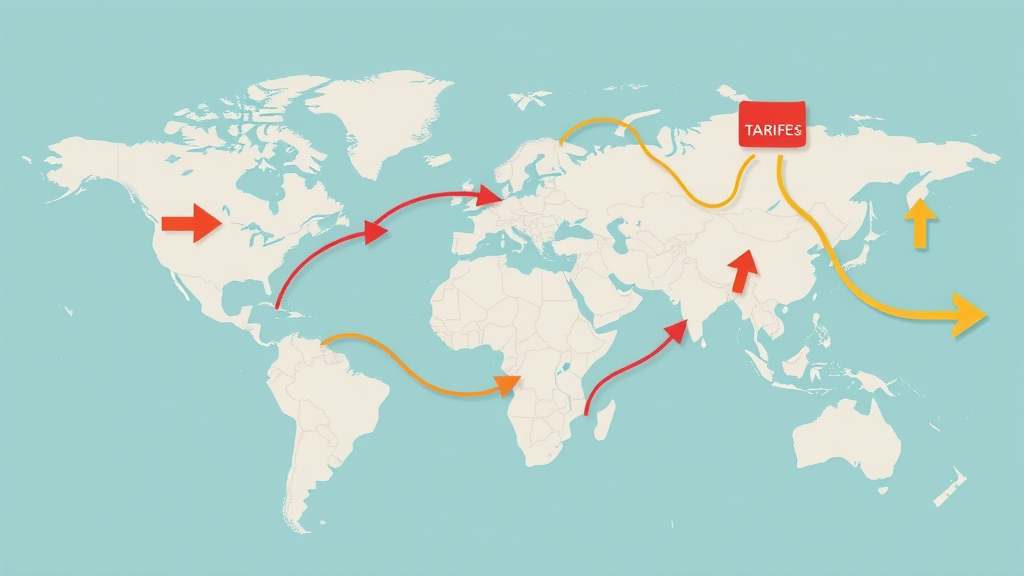

Consider this: When major nations such as the United States, China, or members of the European Union adjust their tariff rates, the shockwaves are immediate. Not only do they affect international trade relationships, but they also send signals through the global economy , challenging businesses to innovate or reconsider their sourcing strategies. This isn’t just about big corporations— global tariff trends create ripples that reach farms, factories, ports, and eventually your home. Understanding these dynamics helps every consumer make sense of the headlines and the hidden forces that impact their everyday life.

So, if you’ve noticed a sudden surge in the cost of imported cars or the disappearance of your favorite snack made overseas, chances are you’re feeling the direct influence of shifting tariffs. These policies shape not just what we buy and how much we pay, but also the economic future we all share.

A Startling Statistic: Over $420 Billion Affected by Global Tariff Trends

The financial magnitude of tariff implementation is hard to ignore. According to recent estimates, global tariff actions in the last five years have impacted more than $420 billion in traded goods and services. This figure covers everything from agricultural products to industrial machinery, and it demonstrates how interconnected—yet fragile—the modern global economy truly is. Whenever trade barriers are raised or lowered, industries adapt, jobs are affected, and consumers ultimately feel the change through their wallets.

"Tariffs are no longer just trade tools—they ripple through every sector of the global economy."

Global Tariff Trends and Their Influence on the United States

No country sits at the heart of the global tariff trends debate quite like the United States . As both a leading importer and exporter, the US is caught up in every new wave of tariff policies, reshaping its position in the global economy. When tariffs are applied to goods imported from China or other trading partners, the costs often flow right down to US consumers and manufacturers, sparking higher prices and changing competitive dynamics. Similarly, American exports encounter new trade barriers abroad, shifting demand and forcing adaptation across industries, from steel and aluminum to automobiles and technology.

The US government’s trade policies, from the White House and Congress, actively influence the global marketplace. Decisions to impose, raise, or lower tariffs send signals to the world, affecting supply chains and investment strategies. As the US seeks to balance its trade deficit and protect American jobs, it must also manage complex alliances and rivalries that result from shifting tariff landscapes. In the end, the trajectory of tariff rates within the United States has a profound impact on both the domestic economy and international trade relationships.

How Tariff Rate Changes Affect the US Economy

Each modification in the tariff rate —whether upward or downward—spark different consequences for the US economy. Recently, increased tariffs on imported goods like steel, aluminum, and technology products have triggered price hikes throughout US industries. These higher costs often trickle down to American families and businesses, creating a new layer of cost-push inflation. At the same time, some companies reconsider their supply chains, seeking ways to bypass new trade barriers or find alternative global suppliers.

In response to shifting global trade policies, US manufacturers might relocate production overseas, reduce staff, or scale down investments. Those reliant on imported goods face immediate uncertainty and potential delays, impacting the predictability and profitability of many businesses. These effects ripple through the broader global economy , frequently leading the US to face pushback from major trading partners who see tariff changes as provocations that warrant reciprocal measures. The end result is often higher prices, unpredictable supply chains, and strained international relationships.

The US’s position as a trade powerhouse means that every adjustment in tariff rates is carefully observed around the world. Consequently, the nation’s economic well-being is deeply intertwined with its approach to global tariffs, making careful policy consideration more important than ever.

US Trade Deficit: The Role of Global Tariff Trends

The persistent trade deficit faced by the United States remains a core motivator for many current and past trade policies. By imposing higher tariffs on imports, government officials often hope to reduce the trade deficit by making foreign products more expensive and less attractive to US consumers, thereby boosting demand for American-made goods. However, changes in global tariff trends are rarely so straightforward in their outcomes.

For one, tariff rate adjustments frequently provoke retaliatory tariffs from trading partners. When China or the European Union responds to US-imposed tariffs with their own trade barriers, American exporters face new obstacles, reducing sales abroad and potentially increasing the trade deficit again. This feedback loop has been especially evident during significant trade disputes with China, where each side raised tariffs, making trading conditions more volatile and costly for both countries.

The reality, then, is that global tariff trends play a double-edged role in the United States’ trade deficit. While higher tariffs can reduce certain imports, they can also create significant challenges for exporters, highlighting the complexity of restoring trade balance in a tightly connected global economy.

Trade Policies from the White House and Their Global Impact

The White House is frequently the epicenter of US trade policy decisions that reverberate globally. With each new administration, priorities shift—sometimes towards protectionism, other times towards free trade. The Trump administration took an aggressive approach to tariffs, particularly on imports from China and other major trading partners, leading to widespread changes in global trade relations. Subsequent policy shifts under new leadership continue to alter the playing field for both US businesses and consumers.

These trade policies often aim to protect US jobs, shore up critical industries, and negotiate more favorable terms for American producers. However, the choices made within the walls of the White House can create global ripple effects: allies and rivals alike respond, creating a cycle of reaction and counter-reaction that contributes to the complexity of world trade. As tariff rates fluctuate, so too do relationships, economic growth trajectories, and the stability of the global economic system.

Understanding the underlying motivations behind US trade policies and recognizing their cascading effects is essential for anyone looking to grasp the bigger picture of global tariff trends today.

Exploring Reciprocal Tariff and Reciprocal Tariffs in Global Trade

At the core of international trade debates is the concept of the reciprocal tariff . A reciprocal tariff structure means that if one country imposes a higher tariff on imported goods, its trading partner responds by matching or mirroring those barriers. This tit-for-tat approach is meant to level the playing field and prevent nations from gaining an unfair advantage through lower tariff rates. Yet, this strategy often leads to a steady escalation of trade barriers, making global commerce more expensive and unpredictable.

Reciprocal tariffs have become especially prominent in the relationships among the world’s leading economies. From the United States and China to the European Union and its trading partners, these mirrored policies can lead to more equitable trade agreements—or spark trade wars over key products such as steel, aluminum, and agricultural goods. Understanding how and why countries deploy reciprocal tariffs is crucial to decoding broader global tariff trends and their impact on the marketplace.

Reciprocal Tariff Structures Among Leading Economies

Among the world’s largest trading blocs, reciprocal tariffs are a favored tool for negotiating fair access to each other’s markets. The United States, European Union, and China have all experimented with reciprocal tariff structures to balance trade relationships and respond to perceived injustices in global trade practices. For instance, when the US raised tariffs on imports from China , China answered with reciprocal tariffs on American goods, directly affecting agricultural exports and manufactured products.

European Union nations, too, employ reciprocal tariffs to defend their interests in world trade scenarios. This arrangement adds a layer of predictability but also paves the way for escalating disputes if negotiations break down. While these policies are meant to ensure fair treatment across the board, they often lead to increased costs, longer negotiation timelines, and industry-wide uncertainty for businesses on both sides of the trade relationship.

The global push for reciprocal tariffs highlights a fundamental truth: in an era of growing economic nationalism, symmetry in trade policy is both a shield and a weapon. For major economies, deploying or refraining from these measures shapes international trade flows and can trigger ripple effects across the entire global economy.

Impact of Reciprocal Tariffs on International Trade Relationships

Reciprocal tariffs may sound like a path to fairness, but their real-world outcomes are often more complicated. When trading partners react to each other’s tariff hikes with matching measures, entire industries are placed in the crossfire. Exports become less competitive, imports grow more expensive, and multi-billion-dollar relationships can sour overnight. The agricultural sector and the tech industry are two of the most frequently impacted, as their products often bear the brunt of retaliatory policies.

Beyond short-term price movements, reciprocal tariffs introduce greater unpredictability into international trade. Businesses that rely on stable, transparent rules find themselves navigating unexpected costs and supply chain disruptions. Countries may try to renegotiate trade agreements, but this process is rarely quick or smooth. Ultimately, every escalation or de-escalation in tariff levels dramatically influences the confidence and stability of the global economy .

While reciprocal tariffs may serve as powerful bargaining chips in trade negotiations, they can also entrench divisions, complicating efforts to build genuine cooperation and sustainable global trade relationships.

Key Countries Implementing Reciprocal Tariffs

- United States

- China

- European Union member states

- Canada

- Mexico

- India

- Brazil

- Japan

Supply Chain and Supply Chains: Vulnerabilities From Global Tariff Trends

If global tariff trends are shifting the big picture of world trade, the most vulnerable parts often reside within our supply chains . These international networks—linking raw materials, manufacturing, transportation, and final sale—can unravel quickly when new tariffs are introduced. An unexpected change in the tariff rate can delay shipments, spike costs, reduce profit margins, and ultimately slow economic growth for entire sectors. Companies are frequently forced to re-strategize, searching for alternate suppliers or logistics partners overseas.

Many industries—especially those dependent on cross-border components, such as technology and automobiles—have experienced direct disruptions from evolving trade barriers. These shocks ripple outward: from the fulfillment warehouse to the retail shop, from food production to semiconductors, no link in the chain is immune. The ability to adapt quickly has become a core requirement for global businesses, not just something to consider for future planning.

As supply chain complexity grows, so do the risks associated with every new wave of global tariff trends . The lessons learned in recent years underscore the need for flexibility, transparency, and the strategic evaluation of new and existing trading partners.

Global Tariff Trends and Challenges for Supply Chains

The last decade has seen mounting pressure on supply chains due to unpredictable tariff rate changes. When tariffs are suddenly raised on critical imports—like steel and aluminum for American cars or semiconductor chips for electronics—companies encounter cascading delays and escalating costs. What was once a streamlined, just-in-time system now faces recurring shocks every time trade policies shift.

Some companies are able to absorb these pressures by passing higher costs onto consumers. Others may downsize operations, source from alternative markets, or in extreme cases, relocate entire production facilities to countries with more stable trade environments. Each response comes with trade-offs, and none fully insulate businesses from the underlying volatility created by global tariff trends .

Ultimately, maintaining efficient and cost-effective supply chains has become an ongoing battle for industries in every corner of the global economy . Moving forward, agility and resilience are likely to be the ultimate competitive advantages.

Examples: Automotive and Electronics Supply Chain Disruptions

Automobiles and electronics offer some of the clearest examples of supply chain disruption due to tariff volatility. When tariffs were hiked on steel and aluminum, car manufacturers in the United States faced higher material costs, directly affecting production budgets and, eventually, consumer prices. Models formerly assembled with globally sourced components became more expensive, and some planned launches were delayed or canceled altogether.

Similarly, the electronics industry, which relies heavily on components made in Asia and imported to Western markets, has felt the impact of changing tariff rates . Higher tariffs on everything from semiconductor chips to finished smartphones mean price increases, sudden shortages, and complicated sourcing decisions. The global push for faster innovation is challenged by the constant need to adjust to new and frequently volatile trade conditions.

For both of these industries—and for countless others— global tariff trends now form part of daily business risk, influencing product development, pricing strategies, and long-term investment decisions.

Comparison of Supply Chain Risk Factors Pre- and Post-Tariff Implementation

| Risk Factor | Pre-Tariff Implementation | Post-Tariff Implementation |

|---|---|---|

| Shipping Costs | Steady/Predictable | Higher/Volatile |

| Supplier Stability | Consistent | Reduced/Uncertain |

| Inventory Levels | Optimized | Increased Safety Stock |

| Market Access | Wide | Restricted/Negotiated |

| Consumer Prices | Stable | Increased |

Trade War and Its Ripple Effect on the Global Economy

The phrase trade war conjures up images of nation-states in economic standoffs, and for good reason: global tariff trends frequently serve as the opening volley in these cross-border conflicts. When countries impose retaliatory tariffs, the resulting standoff generates waves of uncertainty that rock the entire global economy . Investors grow cautious, businesses delay expansion or hiring, and industries linked to international trade must navigate much rougher waters.

The risk of trade war isn’t theoretical; the world witnessed a prime example in the battle between the United States and China beginning in 2018. The subsequent tit-for-tat policies impacted nearly every sector, from agriculture to high-tech manufacturing, forcing governments, companies, and even consumers to adapt quickly to unpredictable changes in the flows of goods and capital.

Trade wars expose the deep-seated vulnerabilities in the modern system of global trade . And while they often begin with one or two products, the ripple effect touches industries, jobs, and economic growth across continents. As future trade disputes arise, the lessons (and consequences) of the last decade are sure to remain prominent in policy thinking around the world.

Global Tariff Trends as Drivers of Trade War

Escalating global tariff trends rarely occur in a vacuum; they are often the result of deep-seated disagreements over market access, technology transfer, or claims of unfair competition. When one nation raises barriers to protect its industries, affected countries react—sometimes with tariffs of their own, and at other times via negotiation. The outcome is frequently a trade war , as seen in the escalating tariffs on steel and aluminum and other strategic goods over the past decade.

These conflicts can rapidly spill over from the original targets to the broader global economy. Retaliatory tariffs mean higher costs for consumers, shrinking demand, and in some cases, lost jobs in sectors dependent on international sales. Meanwhile, companies stuck in the crossfire must decide whether to eat the costs, cut payroll, or try to pass along the financial pain. The uncertainty generated by trade wars discourages investment and slows economic growth, making them serious concerns for world leaders and citizens alike.

Understanding the drivers of trade war helps us see why global tariff trends matter far beyond government statements and trade negotiations—they influence the shape and direction of the modern economic order.

Analysis: The 2018–2019 US-China Trade War and Global Economy

One of the most significant moments in recent global tariff trends was the 2018–2019 US-China trade war. Under the Trump administration , the US imposed sweeping tariffs on hundreds of billions’ worth of imports from China , covering everything from electronics to footwear. China promptly retaliated, leading to months of escalating penalties on both sides. The result: significant pain for US farmers and manufacturers, significant shifts in global supply chains, and widespread economic uncertainty internationally.

These events triggered a pronounced slowdown in global economic growth, as businesses grappled with the unpredictability of future tariffs or additional restrictions. Some companies moved production out of China or diversified their supplier base, while others scrambled just to keep pace with new regulatory environments. The damaging effects on the agricultural, technology, and automotive sectors were particularly noticeable in the US, while Chinese exporters sought new markets to mitigate their own losses from lost American sales.

Ultimately, the US-China trade war revealed just how deeply entrenched and influential tariff rates and trade policy are in shaping the global economic system. The lessons from this episode continue to inform negotiations, economic policy, and corporate strategy worldwide.

Tariff Rates: How Tariff Rate Fluctuations Shape Global Trade

One of the most important variables in global tariff trends is the actual tariff rate applied to imported goods. These rates fluctuate in response to negotiations, economic pressures, and political developments—often with immediate consequences for world trade. High tariffs create significant trade barriers , discouraging cross-border business and sometimes sparking economic retaliation from trading partners. Lower rates typically encourage more open markets and greater competition on a global scale.

For businesses, tracking the ebb and flow of these tariff rates is essential. A sudden hike or drop can impact profitability, sourcing decisions, and competitive positioning overnight. For consumers, the result translates to changes in the price and availability of goods, from cars and appliances to imported food and electronics. Ultimately, the story of global trade is inseparable from the rise and fall of tariff rates around the world—not just in developed economies, but across emerging markets too.

Understanding where and why tariff rates move offers a powerful lens into today’s economic realities and gives insight into the trends that will shape tomorrow’s trade landscape.

Current Tariff Rates: A Breakdown by Region

Tariff rates vary widely by region and by industry sector. The United States, European Union, China, Japan, and emerging markets all apply different rates to different categories of imported goods . For instance, the US currently maintains higher tariffs on strategic imports like steel, aluminum, and select technology products, while applying lower rates on many consumer goods. The European Union, by contrast, offers relatively low average rates but actively defends sectors like agriculture and automobiles from outside competition through targeted tariffs.

China’s tariff structure often reflects its domestic priorities, using high rates on particular imports to protect national industries, while experimenting with tariff reductions in certain areas to foster economic openness. In emerging markets, tariff policymaking swings between encouraging foreign investment and protecting nascent industries. Understanding these regional nuances is critical for businesses involved in the import-export trade, and even for informed consumers wanting to grasp the broader forces behind pricing trends.

Tracking updates in regional tariff rate tables provides a valuable snapshot of the current global trading environment and ongoing market shifts prompted by changes in global tariff trends .

Tariff Rates Across Major Trading Blocs

| Trading Bloc | Average Tariff Rate | Key Tariffed Goods |

|---|---|---|

| United States | 1.6% (overall); 10-25% (steel/aluminum) | Steel, Aluminum, Technology, Autos |

| European Union | 1.7% (overall); Up to 10% (autos) | Agriculture, Automobiles, Textiles |

| China | 3.5% (average); Higher on tech | Electronics, Automobiles, Food Products |

| Japan | 2.5% (average) | Agriculture, Vehicles, Electronics |

| Canada & Mexico | 0.8% - 7% | Steel, Dairy, Autos |

The Impact of Tariff Rate Changes on Imported Goods

Whenever tariff rates shift—even by a small percentage—the results are quickly felt by producers, retailers, and consumers. A higher tariff rate increases the cost of imported goods , making them less competitive against domestic products. For example, US tariffs on Chinese electronics and machinery led to a noticeable rise in prices for everything from smart TVs to home appliances. In turn, American manufacturers sometimes gained short-term advantages but lost access to key inputs, often leading to rising production costs and slower innovation.

For consumers, higher tariff rates mean direct pain in the form of more expensive products. Meanwhile, global companies must continually reassess their sourcing strategies, sometimes shifting manufacturing to lower-tariff countries. Broadly, tariff volatility saps confidence from markets and consumers alike, making it harder for everyone to plan and invest for the future.

The aggregate effect of these trends is to make global trade costlier and less predictable—a dynamic that shapes not only supply and demand but also the competitiveness of entire industries on the world stage.

Presidential Influence: The Trump Administration and Modern Trade Policy

The election of President Donald Trump in 2016 marked a pivotal moment in global tariff trends and US trade policy . The Trump administration adopted a more confrontational approach, especially towards China and long-standing allies, arguing that previous agreements put US workers and industries at a disadvantage. By sharply raising tariffs on goods from trading partners—most notably during the trade war with China—the administration aimed to stimulate domestic industry and reduce the trade deficit, but the strategies unleashed both intended and unintended consequences on the global economy.

Trade policies enacted under Trump extended beyond tariffs alone to include renegotiated trade deals, such as the United States-Mexico-Canada Agreement (USMCA), and aggressive rhetoric intended to secure new terms from major allies. The period saw both volatility and renewed interest in the broader impact of US trade policy on the world stage. For businesses and consumers alike, these shifts represented a period of profound adjustment, highlighting how much presidential priorities shape international commerce.

As the Biden administration navigates forward, many of these changes remain in play, making it clear that the White House will continue to exercise enormous influence over tariff setting and global economic direction.

From President Trump to Biden: Evolving Trade Policies

The passage from the Trump administration to the Biden administration has introduced nuanced adjustments to American trade policy . While President Biden has reversed some of his predecessor’s actions and sought to rebuild traditional alliances, the enduring impact of heightened tariffs on key goods—especially those targeting China—remains clear. The transition has brought increased collaboration with global partners even as domestic supply chain resilience and competitive positioning remain top priorities.

The new administration’s approach blends select continuity (keeping tariffs in strategic sectors) with an openness to dialogue, seeking to avoid all-out trade wars while still defending American interests. This more measured approach affects not only import/export companies but also consumers, who are sensitive to the price swings linked to these evolving global tariff trends . Moving forward, both US and international businesses must keep a close eye on policy signals from Washington to anticipate further changes.

Both administrations, despite differing priorities and rhetoric, underscore the powerful effect that leadership changes can have on the global trading system—and by extension, on the costs and opportunities faced by everyday Americans.

Effect of Trump Administration Trade Policy on Global Tariff Trends

The aggressive tariff hikes implemented under the Trump administration altered the trajectory of global tariff trends for years to come. By imposing broad sanctions on Chinese imports and facing off with the European Union, Canada, and Mexico on steel and aluminum tariffs, the administration signaled a break with decades of US-led liberalization. This approach sparked a global spike in reciprocal tariffs, pushing other economies to defend themselves and, in turn, raise barriers to American goods.

In response, supply chains were forced to adapt at breakneck speed, with manufacturers rerouting components and final assembly to avoid the worst of trade war headwinds. The resulting policy uncertainty contributed to investment slowdowns and export drop-offs worldwide. While the intention was to strengthen American industry and reduce foreign reliance, the actual impact was a more fragmented and contentious world trading system, with economic growth in many regions temporarily subdued.

Looking forward, the broad changes enacted during the Trump presidency continue to shape how policymakers and business leaders think about the use of tariffs—not just as tools for negotiation but as lasting features of international commerce that demand new strategies and resilience.

Global Tariff Trends and the European Union: Shifting Alliances

The European Union sits at the intersection of numerous global tariff trends . As one of the world’s largest trading blocs, the EU must constantly adjust its trade agreements amid shifting tariffs imposed by the United States, China, and emerging markets. The complexity of managing policies for 27 member nations amplifies both the opportunity and risk inherent in every new trade barrier or agreement. EU policymakers regularly negotiate with other major powers not just for goods access, but also in response to evolving technology, digital services, and green economy needs.

Shifts in alliances and confrontations between the EU and its key trading partners—especially the US and China—have prompted innovation in trade policy. This has resulted in a blend of defensive strategies (protecting core industries) and proactive engagement in new markets. Recent experiences have underscored the EU’s vulnerability to supply chain shocks and forced a rethink of long-standing strategies for securing stable international trade.

The importance of agility in response to tariff rates and new trade rules has never been more evident for Europe, making nimble policy making at both national and supranational levels an essential part of the continent’s economic security.

European Union Trade Agreements Amid New Tariff Barriers

Trade agreements form the backbone of the European Union ’s defense against shifting global tariffs. Over the past decade, the EU has focused on securing long-term stability through deals with Canada (CETA), Japan (EPA), and now negotiating new compacts with Australia, Mercosur, and others. These agreements often address not only traditional goods but also services, digital commerce, and regulatory standards—designed to shield European exporters and consumers from sudden trade shocks triggered by external tariff hikes.

When new trade barriers emerge, these agreements can offer member states reliable market access and agreed-upon pathways for resolving disputes. At the same time, the rise of economic nationalism and reciprocal tariffs globally ensures that the EU must stay vigilant, continuously updating its policy approach to address evolving threats. In this dynamic environment, agility and diplomatic skill are as important as economic prowess for maintaining Europe’s competitive edge.

From ‘tariff ceilings’ to mutual recognition clauses, the content and complexity of EU trade agreements now reflect a world where shifting alliances and fast-moving global tariff trends are simply the new normal.

The EU’s Response to US and China Global Tariff Trends

The European Union has found itself in a balancing act as US-China tensions escalate and new tariffs emerge. Its response has been twofold: doubling down on intra-European solidarity while seeking diversified relationships globally. The EU’s countermeasures to American tariffs (like those targeting steel and aluminum) have included reciprocal tariffs and strategic support for key sectors. Facing China, the EU has favored negotiation over confrontation but has still moved to correct trade imbalances and protect its industries from unfair practices.

These policies have spurred new debates within the EU around how best to insulate Europe from external shocks, drive innovation, and maintain influence amid rising global nationalism. While the path forward remains uncertain, the consensus is clear: adapting to the vortex of global tariff trends will require both nimble policy and deep international cooperation.

"Europe finds itself between giants, redefining its trade strategies in a world of shifting tariffs."

Trade Agreements and National Trade: Responding to Tariff Barriers

Trade agreements remain the single most effective tool for nations looking to circumnavigate the unpredictability of global tariff trends . By negotiating bilateral or multilateral deals, countries gain clarity, stability, and market access that aren’t subject to the constant churn of trade war rhetoric or sudden policy changes. For the United States, Canada, and Mexico, the passage of USMCA marked a turning point in leaving behind the NAFTA era and adapting to modern industrial and digital realities.

Strong trade agreements can shield industries and consumers from the most disruptive tariff shocks. Yet, with rising nationalism and the weaponization of tariffs, the challenge is to ensure these deals keep pace with both economic and geopolitical shifts. As emerging players like India and Brazil ramp up their influence, the patchwork of global trade agreements looks likely to grow even more complicated in the coming decade, demanding creativity and diplomatic skill from negotiators everywhere.

In the end, a strong web of trade agreements helps national economies weather the storms of global tariff trends while maximizing the benefits of open markets and competition.

The Role of Trade Agreements in Navigating Global Tariff Trends

Trade agreements provide predictable frameworks that allow businesses and consumers to plan beyond the volatility inherent in fluctuating tariff rates . Whether in the context of new digital industries or traditional manufacturing, these agreements are critical to fostering growth in a world hungry for certainty. They help resolve disputes, set mutually accepted standards, and, where necessary, offer buffer protections against the sharpest upheavals in international trade.

Especially in an era where short-term policy reversals and reciprocal tariffs are common, these long-term arrangements underpin economic resilience. Smart negotiation and ongoing review of these deals are indispensable as nations strive to balance domestic priorities with global responsibilities.

For companies and communities that rely on cross-border trade, these agreements represent their best hope for sustainable, predictable business in an otherwise tumultuous global market.

Canada and Mexico: Adapting to US Tariff Rate Policies

Among the United States’ top trading partners, Canada and Mexico have faced particular challenges from shifting American tariff rates . Both countries rely heavily on exports to the US, especially in key areas like autos, agriculture, and energy. When the Trump administration targeted steel and aluminum, or imposed broad tariffs during NAFTA renegotiation, Canadian and Mexican industries were forced to adapt quickly—seeking new markets, renegotiating supply contracts, and absorbing temporary economic pain to preserve long-term relationships.

The successful negotiation of the USMCA provided some relief, safeguarding many trade flows and updating older agreements to better reflect contemporary realities. However, the continuing volatility in US tariff setting means that both Canada and Mexico must remain agile, constantly assessing risks and opportunities. Their experiences exemplify the broader challenge for all countries tied to the world’s biggest economies: enduring uncertainty while positioning for advantage in the next phase of international trade.

Globally, the lessons learned by Canada and Mexico are a warning and an inspiration—reminding us that adaptation, innovation, and diplomacy are more vital than ever in managing global tariff trends .

People Also Ask

How do global tariff trends affect everyday consumers?

Global tariff trends directly impact prices on imported goods, resulting in higher costs for everyday items, from electronics to groceries. The shifts can also affect employment within certain industries and lead to supply chain delays.

What is the relationship between supply chain disruptions and tariff rate increases?

When tariff rates increase, supply chains face additional costs and uncertainty, often prompting companies to seek alternative suppliers or pass on costs to consumers.

FAQs about Global Tariff Trends

- What are global tariff trends? Global tariff trends refer to the evolving patterns in tariff rates and trade barriers imposed by countries on imported goods, shaping the direction of world trade and affecting consumers, businesses, and national economies worldwide.

- How do tariffs influence the global economy? Tariffs affect the global economy by altering the price of imports and exports, which influences global supply chains, shifts competitive advantages, and determines the flow of goods and capital between nations.

- What is a reciprocal tariff? A reciprocal tariff is a trade policy where a country matches the tariffs that its trading partner imposes, typically as a countermeasure or negotiation tactic to ensure equal access and market fairness.

- Why do countries engage in trade wars? Countries engage in trade wars to protect domestic industries, respond to perceived unfair trade practices, or negotiate more favorable trade agreements, often by raising tariffs in a series of competitive and retaliatory moves.

Key Takeaways: Understanding the Impacts of Global Tariff Trends

- Global tariff trends influence supply chains, consumer prices, and national economies.

- Trade policies from the US, China, and the EU reshape global markets.

- Reciprocal tariffs create new complexities for international trade.

- Tariff rates and trade wars are directly tied to economic growth and stability.

Looking Ahead: The Future of Global Tariff Trends

The world of global tariff trends is anything but static. As new technologies, sudden supply chain crises, and shifting alliances emerge, the pressure on governments to reconsider tariff policies will only intensify. With economic growth at stake, policymakers, businesses, and consumers must stay nimble and informed in the face of this ongoing change.

Predictions for Upcoming Trade Policies and Tariff Rates

Experts predict that the focus on supply chain resilience, technological competitiveness, and climate-related industries will increasingly shape future tariff policies. Trade agreements will likely evolve to address not only traditional goods but also services, digital technology, and national security concerns. Tariff rates may fluctuate more frequently as governments use them to address short-term economic challenges and longer-term strategic goals.

Nations are expected to maintain an active stance on reciprocal tariffs, especially as geopolitical tensions ebb and flow. Meanwhile, consumers should anticipate potential oscillations in prices and availability of imported products depending on the pace and substance of these policy shifts.

In such an environment, proactive adaptation—by both governments and the business community—will be key to maintaining competitive advantage and sustainable economic health.

How Consumers and Businesses Can Prepare

For businesses, diversifying supply chains and investing in transparent, data-driven sourcing strategies can help manage tariff risk. Staying informed about the direction of global tariff trends allows for timely pivots and helps avoid costly disruptions. Consumers, meanwhile, can make conscious purchasing decisions, support local industries, or budget for price shifts on imported goods.

The most successful market participants in the years ahead will be those who view ongoing shifts in tariff rates and trade policies as opportunities for innovation and collaboration. Preparing now means gaining the flexibility to face the next wave of global economic change with confidence.

"In an interconnected world, global tariff trends are everyone’s concern, not just the domain of policy makers."

Further Exploration and Invitation to Engage

Stay Informed and Make Your Voice Heard on Global Tariff Policy

Remaining aware of global tariff trends is no longer an option reserved for politicians and economists—today, it is essential for any well-informed citizen, consumer, or business owner. Leverage credible news sources, subscribe to trade policy updates, and participate in forums that address world trade and its impact on your community.

Your insights and opinions matter, as collective voices can shape the direction of future policy and business practices worldwide. Engaged citizens play a crucial role in advocating for fair and sustainable trade policies that balance economic security with openness and innovation.

Share your perspective: How have global tariff trends impacted you or your business?

Have you noticed a change in prices at your favorite store? Has your business faced new challenges or opportunities from shifting tariffs? Share your experiences and strategies for coping with or taking advantage of global tariff trends . Join the conversation to help others understand and adapt to a rapidly changing world economy.

Conclusion

Adapting to global tariff trends means staying informed, fostering supply chain resilience, and advocating for balanced policies. Individuals and businesses alike should plan for volatility, prioritize flexibility, and engage in dialogue influencing the future of global trade.

Add Row

Add Row  Add

Add

Write A Comment