Did you know that over 60% of advanced manufacturing facilities now use laser welding applications to achieve precision and efficiency unmatched by traditional welding methods? From car makers speeding up assembly lines to medical device manufacturers achieving microscopic accuracy, laser welding is transforming how industries join materials and innovate new products. If you’re curious about how these powerful welding solutions could elevate your business or reshape your market, you’re in the right place.

Why Laser Welding Applications are Revolutionizing Modern Manufacturing

- Over 60% of advanced manufacturing facilities now implement laser weld processes.

- Laser welding solutions achieve three times the precision of traditional welding methods.

- Automotive industry adoption of laser welding boosts production efficiency by 30%.

The rise of laser welding applications is not simply a trend—it's a step-change in how manufacturers, big and small, tackle production challenges. By harnessing laser beams for welding, companies achieve higher precision, minimized heat-affected zones , and the ability to join both similar and dissimilar metals . For example, in the automotive industry , integrating laser weld systems has led to a staggering 30% boost in productivity , while also enabling lighter, stronger vehicle designs. Additionally, reduced labor requirements and high-speed automation make laser weld solutions particularly attractive for businesses seeking to lower costs while improving quality.

Expertly engineered laser welding systems now underpin the production lines of leading manufacturers in electronics, medical devices, aerospace, and beyond. By delivering consistent quality welds with less post-processing, these systems free up resources and reduce waste—helping companies stay agile in a fiercely competitive landscape.

A Comprehensive Overview: What You'll Learn About Laser Welding Applications

- Key concepts and types of laser welding applications

- Comparison between laser welding and traditional welding methods

- Industry-specific uses and success stories

- Knowledge on materials, capabilities, and safety

- Trends, challenges, and advantages of modern laser weld solutions

This comprehensive guide covers everything from the fundamental welding process and core advantages of laser technology, to real-world case studies and the future trends poised to re-define the field. Whether you're a production engineer, an executive looking for cost savings, or a curious student, you’ll gain a clear, actionable understanding of how laser welding applications drive innovation across modern manufacturing.

Understanding the Fundamentals: Laser Welding Applications Explained

What is Laser Welding and How Does It Work?

"Laser welding is a welding method that uses a laser beam to join materials, offering unmatched speed, accuracy, and minimal heat-affected zones compared to traditional welding."

At its core, laser welding is a technique where a tightly focused, high-energy laser beam creates a precise weld seam by instantly melting the edges of metals or thermoplastics. This welding method stands out by delivering a low heat , highly controlled fusion zone, enabling the joining of similar metals as well as combinations of dissimilar metals that often prove challenging for traditional welding techniques.

Laser welding systems are prized for their high precision , often facilitating welds just fractions of a millimeter wide. Automated laser welders can be programmed for complex shapes or consistent repeatability, making them ideal for both mass production and the creation of intricate components—like micro-electronics or surgical tools—where accuracy is paramount. Compared to traditional welding methods, the laser welding process dramatically reduces part distortion, removes the need for filler materials, and allows for scalable automation.

Core Welding Methods: Laser Weld vs. Traditional Welding Methods

| Parameter | Laser Welding | Traditional Welding |

|---|---|---|

| Heat-Affected Zone | Minimal | Larger |

| Precision | High | Moderate |

| Material Compatibility | Wide range (incl. dissimilar metals) | Similar metals primarily |

| Speed | Faster | Generally slower |

| Automation | High | Moderate to Low |

When comparing laser welding to traditional welding methods like arc welding or TIG welding , several differences emerge—the most important being the minimal heat-affected zone (HAZ) created by lasers. This smaller HAZ reduces thermal expansion and distortion, resulting in stronger, more reliable connections, particularly in components that demand tight tolerances. Furthermore, laser welding creates clean and consistent results with significantly less post-processing. While traditional welding remains suitable for some large-scale structural projects or where only similar metals are involved, its larger affected zone, slower speed, and higher labor requirements can limit productivity and finish quality.

Notably, laser welding systems are now being tailored to operate with a wide range of materials, including sensitive electronics or precious medical assemblies, where conventional welding methods simply can't deliver the required accuracy or minimal part contamination. In short, the laser approach allows for more adaptability, higher quality welds, and better efficiency in demanding applications.

Types of Laser Welding Applications and Methods

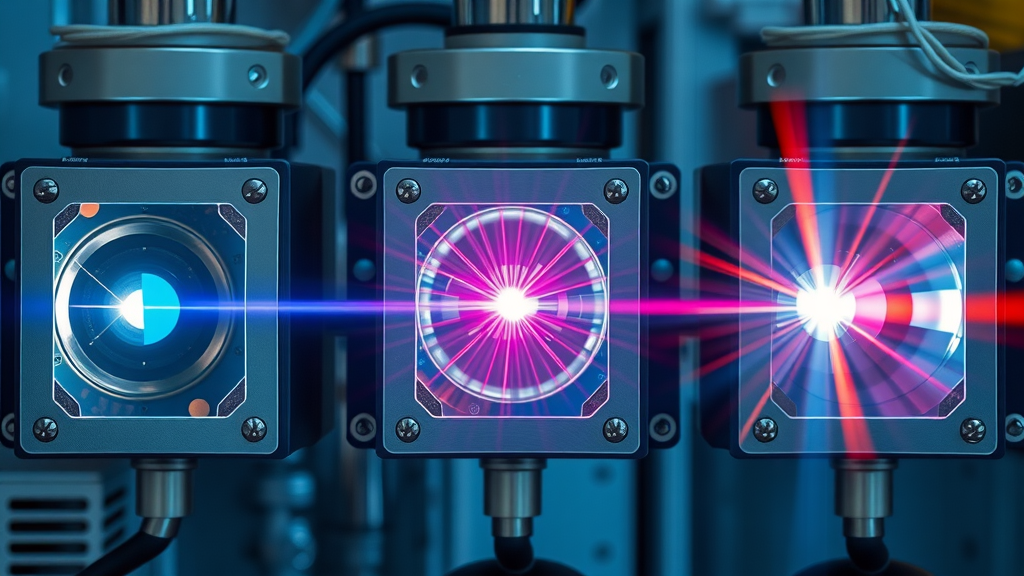

Laser Beam Types: Fiber Laser vs. CO2 and Nd:YAG

Three primary types of laser beam sources lead the industry for laser welding applications: fiber laser , CO2 laser, and Nd:YAG laser systems. Each has unique advantages and is best suited for specific welding work . Fiber lasers dominate modern manufacturing thanks to their energy efficiency, compact size, and ability to deliver highly focused beams—making them a top pick for precision and speed in joining both similar and dissimilar metals. CO2 lasers, with their longer wavelength, excel at non-metallic materials or thicker metal sections. Nd:YAG lasers offer flexibility, especially in welding reflective metals like gold or welding tiny electronics.

Choosing between these welding systems hinges on application needs: for automotive body assembly or electronics manufacturing, fiber laser welding is often the preferred solution, owing to its consistency and cost-effectiveness. Industries dealing with exotic or reflective materials might opt for Nd:YAG for specialized tasks. Ultimately, matching the type of weld to the correct laser source maximizes weld quality and throughput.

Selecting the Optimal Welding Solution for Your Application

- Choosing between dissimilar metals and similar metals

- Considering joint type and thickness

- Understanding industry requirements for precision and speed

Selecting the right laser welding solution begins with material analysis. Welding similar metals (such as steel-to-steel) is generally more straightforward, while dissimilar metals (like aluminum-to-copper)—a frequent requirement in battery technology or electronics—require careful control over energy input and often benefit most from advanced laser systems. Joint type (butt, lap, fillet) and material thickness will also guide the power and focus attributes needed for a precise weld .

Industry-specific requirements—like the high speed and reliability demanded in the automotive industry, or the flawless microscopic joins needed for medical implants—may further dictate the choice of laser welding system . The latest welding solutions even allow dynamic adjustment of laser parameters in real time, ensuring that every weld seam is strong, clean, and meets the exact requirements of the production line.

Laser Welding in the Automotive Industry: Real-World Impact

Automotive Laser Weld Use Cases and Success Stories

- Chassis assembly

- Battery welding for electric vehicles

- Body and roof joint welding

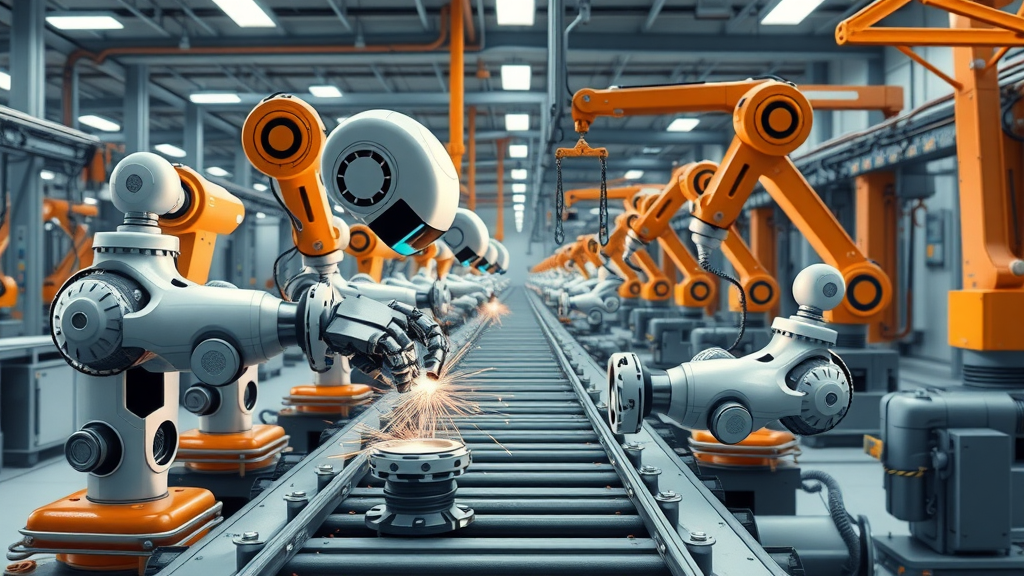

- Precision component fabrication

The automotive industry is one of the largest adopters of laser welding applications , driven by the need for lighter, more robust vehicles and the push for rapid, cost-effective manufacturing. In electric vehicle (EV) production, precision laser weld methods have become essential for battery tab and busbar welding—joining dissimilar metals like copper and aluminum with consistent, defect-free seams. Not only do these solutions enable manufacturers to create safer, longer-lasting batteries, but they also reduce the risk of shorts and energy losses.

On assembly lines, robotic laser welding systems are used for everything from chassis and body panel assembly to roof seam welding, delivering joints that are both visually appealing and structurally superior. The ability to automate these welds with minimal oversight means manufacturers can increase throughput while ensuring each car meets stringent quality standards. Success stories aren’t just about speed—laser welding also enables innovative vehicle designs and the integration of lighter, high-strength alloys, helping automakers meet today’s efficiency and safety demands.

Expanding Horizons: Laser Welding Applications in Medical, Aerospace, and Electronics

How the Medical Industry Benefits from Laser Welding Applications

- Minimally invasive instrument manufacturing

- Precision welding in pacemakers and implants

- Welding of micro-electronic components

In the medical industry , the demand for miniaturized, highly precise, and biocompatible components has made laser welding applications a gold standard. Instruments for minimally invasive procedures—scalpels, endoscopes, or guide wires—require strong, clean joints free from contamination, oxidation, or heat distortion. Laser welding delivers on each of these needs, and can even join delicate components without the need for additional filler material.

Medical device manufacturers increasingly turn to specialized laser weld solutions to create hermetically sealed pacemakers, implants, and tissue-contact instruments. The fine control of energy and beam placement afforded by lasers protects sensitive electronics inside devices while ensuring reliable, long-lasting bonds at scales invisible to the naked eye. This level of safety, consistency, and speed is difficult to match with any other welding method .

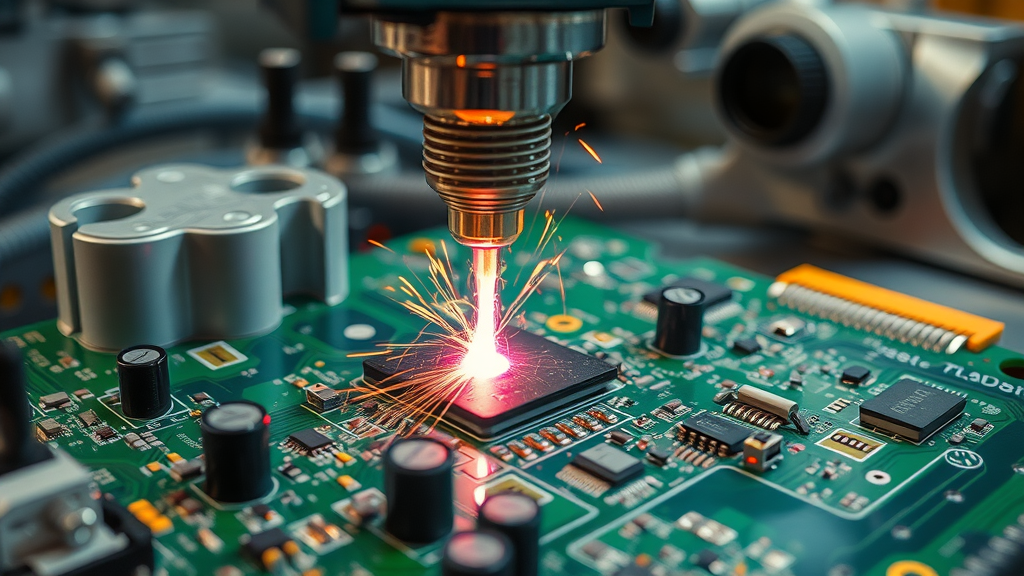

Laser Weld Solutions in Aerospace and Electronics

- Joining titanium and other advanced alloys (dissimilar metals)

- Fabricating intricate sensors, circuit boards, and microchips

- Reducing the risk of defects in high-value components

Aerospace engineering stands on the bleeding edge of laser welding innovation . Here, the ability to seamlessly join advanced alloys such as titanium or even different metal types allows aircraft and spacecraft manufacturers to build stronger, lighter, and more reliable frames and systems. In electronics, laser beams enable the welding of tiny wires, connectors, microchips, and circuit boards—operations where conventional welding would destroy sensitive elements through excess heat or imprecision.

Thanks to the flexibility and pinpoint accuracy of modern fiber laser and CO2 systems, manufacturers can drastically reduce defect rates in critical aerospace or electronic systems. This is especially vital considering the extremely high costs associated with component failures in these sectors. Ultimately, laser welding solutions empower the reliable creation of complex, miniaturized, or custom assemblies that help propel these industries forward.

Advantages of Laser Welding Applications Over Traditional Welding Methods

- Reduced heat-affected zone for minimal part distortion

- Superior weld quality on both similar and dissimilar metals

- Greater speed leading to enhanced productivity

- Flexible automation and ease of integration

- Clean, repeatable, and strong joints

"For electronic and medical devices, the precision of laser welding solutions is unmatched, enabling the joining of smallest parts safely and reliably."

The clear, measurable benefits of laser welding versus traditional welding explain why so many industries are rapidly making the switch. Lasers apply heat only where needed and only as long as required, which dramatically reduces the affected zone and associated structural changes such as warping or weakening. This is particularly important when precision and repeatability are crucial, such as in electronics or surgical tool manufacturing.

Laser welders can easily handle both similar metals and dissimilar metals —which is critical in advanced battery manufacturing, lightweight transportation, and hybrid component production. Unlike traditional processes, laser welding integrates seamlessly into automated production lines, allowing companies to scale up output while maintaining consistently high weld seam quality. The result is a significant boost in productivity, cost savings, and the ability to innovate with new materials and assembly techniques.

Laser Welding Process Optimization: Wide Range of Industrial Applications

Welding Solutions for Dissimilar Metals and Complex Assemblies

- Battery tab welding

- Busbar and connector welding

- Joining aluminum to copper and other challenging metal pairs

Modern laser welding applications are pushing technological boundaries, making it feasible to reliably join metal pairs once deemed incompatible. Innovations in process monitoring, beam shaping, and energy delivery mean that even thin foils or thermally sensitive components can be securely joined, unlocking new design paradigms across electric vehicles, renewable energy, and consumer electronics.

The capabilities of laser beam welding now extend to ever more complex assemblies—busbars for EV battery packs, connector systems for smart appliances, or aluminum-to-copper joins for heavy-duty power cells. By precisely controlling heat and energy input, manufacturers can minimize defects, prolong product lifespan, and lower rejection rates.

Customizing Laser Welding Solutions for Unique Manufacturing Needs

- Integrating laser weld technology into existing production lines

- Tailoring laser parameters for new materials

- Solving high-mix, low-volume challenges with precision

No two manufacturing environments are identical, which is why many leading companies turn to customized laser welding solutions . These tailored systems can be integrated into legacy production facilities or designed from scratch for high-mix, low-volume assembly work. Through real-time adjustment of laser parameters and integration with robotics, businesses address new materials, accelerate time-to-market, and meet even the tightest tolerances.

Whether you're looking to update an automotive plant, scale up aerospace fabrication, or meet the unique needs of medical device production, a laser welding solution can be engineered to your requirements. Advanced software controls, machine vision quality checks, and ongoing monitoring make it easier than ever to ensure safety, consistency, and process traceability for every welding work cycle.

Challenges and Solutions in Industrial Laser Welding Applications

Managing Heat Affected Zone and Structural Integrity

Although laser welding applications offer minimized heat-affected zones compared to traditional methods, managing residual stress and microstructural changes is key to delivering robust, reliable products. By using optimized beam shaping, real-time temperature feedback, and post-weld treatments, manufacturers ensure the structural integrity of even the most delicate assemblies. Consistent process monitoring with sensors and AI algorithms can help further drive down variability.

Overcoming Material and Design Constraints

The integration of laser welding systems sometimes encounters hurdles with material reflectivity, thickness variations, or unconventional joint geometries. Modern welding solutions address these with adaptive optics, programmable pulse patterns, and in some cases, collaborative robots that ensure every part is presented for welding in precisely the right position and orientation.

"Laser welding methods have enabled the creation of lighter, stronger assemblies across industries, but success relies on detailed control and process monitoring."

Overcoming these design and material constraints requires detailed feasibility analysis and robust system integration, making partnerships with experienced laser welding solution providers essential. This collaborative, data-driven approach helps ensure that even the most ambitious product designs are manufacturable at scale—safely, reliably, and profitably.

Future Trends: Innovations in Laser Welding Technology

- Growth of AI-powered, self-monitoring welding solutions

- New compact and fiber laser devices for mobile applications

- Development of hybrid laser welding with improved cost efficiency

The next decade in laser welding applications will be shaped by leaps in automation, mobility, and real-time control. AI-powered welding systems are already being deployed to monitor weld seams for defects, automatically adjust laser parameters, and even predict maintenance before breakdowns occur. Meanwhile, compact fiber laser devices open the door for mobile and remote field repair work previously out of reach for high-precision laser welding systems.

Hybrid welding solutions that combine the strengths of various laser beam and conventional processes promise even greater flexibility for expanding industrial applications while keeping costs in check. As manufacturers embrace these trends, expect even broader adoption and new benchmarks of productivity, safety, and sustainability in welding work worldwide.

People Also Ask – Addressing Key Laser Welding Application Questions

What is a laser welder used for?

- A laser welder is used for joining metals and plastics with high precision, enabling strong, clean, and repeatable weld seams in manufacturing applications ranging from automotive to electronics and medical devices.

What industries use laser welding?

- Key industries employing laser welding applications include the automotive industry, aerospace, medical device manufacturing, electronics, energy, and consumer goods production.

What are the 5 applications of laser?

- Cutting and joining metals (welding)

- Medical equipment manufacturing

- Precision electronics fabrication

- Laser marking and engraving

- Material surface treatments

What are the applications of laser welding in the automotive industry?

- Battery connections and tab welding

- Chassis assembly and body frame joints

- Sensor welding and component integration

- Lightweighting structures via advanced joining methods

Frequently Asked Questions about Laser Welding Applications

-

How safe is the laser welding process compared to traditional welding methods?

Laser welding is typically safer due to lower heat and fewer sparks, but it does require strong safety protocols to guard against direct or reflected laser exposure. Proper shielding and operator training are crucial for safe operation. -

What materials benefit most from laser weld technology?

Materials that require high precision, such as aluminum, titanium, copper, stainless steel, and a variety of advanced alloys, as well as plastics for certain specialized applications, achieve superior results with laser welds. -

How does fiber laser welding differ from other laser sources?

Fiber laser welding offers improved energy efficiency, compactness, and higher throughput compared to CO2 or Nd:YAG lasers, especially for industrial-scale operations involving both thick and thin materials. -

Can laser welding be fully automated for large-scale production?

Yes, today’s laser welding systems are engineered for full automation, supporting high-speed, large-volume production with real-time quality monitoring and process controls. -

What is the typical cost comparison between laser weld and traditional welding processes?

Initial investment in laser welding systems is higher, but cost savings accrue rapidly due to faster throughput, lower consumable costs, higher yield, and reduced need for post-processing or rework.

Key Insights to Remember about Laser Welding Applications

- Laser welding delivers unmatched precision and speed across a wide range of industries.

- Modern laser weld methods support both similar and dissimilar metals for innovative assemblies.

- The minimized affected zone reduces thermal distortion and improves final part quality.

- Industry trends suggest expanding use of fiber laser and AI-driven welding solutions.

Secure your Competitive Edge with Precision Laser Welding Applications

"Facing Tariff Pressures? It’s Time to Reshore Smarter. At Electronic Service Products, we specialize in precision laser machining solutions that meet the highest quality standards—onshore, on time, and on budget. Whether you're looking to reshore your manufacturing or avoid the mounting cost of overseas tariffs, we offer the speed, precision, and flexibility your supply chain demands. 👉 Call today 203-265-4167 or go to espcnc.com/request-a-quote "Conclusion:

Take the next step: Evaluate your processes and explore tailored laser welding solutions for precision, speed, and innovation—options are available for every industry and application.

Laser welding is revolutionizing various industries by offering precision, efficiency, and versatility unmatched by traditional welding methods. For a deeper understanding of its diverse applications, consider exploring the following resources:

- “Laser Welding Process: Techniques, Applications, and Benefits” ( shop.machinemfg.com )

This article provides an in-depth look at laser welding’s role in industries such as automotive, medical devices, and electronics, highlighting its precision and efficiency.

- “Exploring the Versatility of Laser Welding: Applications Across Industries” ( ebindustries.com )

This resource delves into how laser welding is utilized in sectors like aerospace, electronics manufacturing, and medical device fabrication, emphasizing its adaptability and benefits.

If you’re serious about understanding how laser welding can transform your industry, these resources will provide valuable insights into its applications and advantages.

Add Row

Add Row  Add

Add

Write A Comment